Last week brought an unexpected jump in first-time jobless claims

Futures on the Dow Jones Industrial Average (DJI) are down over 175 points at last check, set to sharply reverse course from yesterday's record close. S&P 500 Index (SPX) and tech-heavy Nasdaq-100 Index (NDX) futures are firmly in the red too, as the tech sector continues to pull back.

Investors are also weighing the latest corporate earnings with lackluster economic data. Initial jobless claims for last week unexpectedly rose to 861,000, and the week prior was revised to 848,000 from 793,000. U.S import prices rose as well, while housing starts fell 6% in January.

Continue reading for more on today's market, including:

- Warren Buffett buzz brings options bulls to Verizon stock.

- The utility stock seeing plenty of pent-up pessimism.

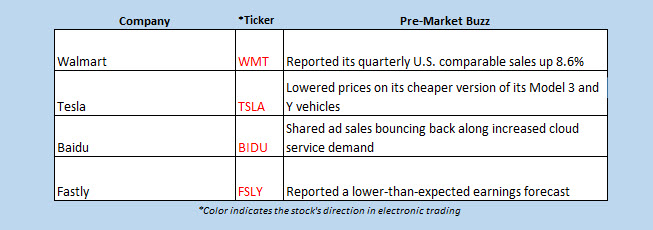

- Plus, WMT dips on a forecast warning; Twilio stock surges after earnings; and MAR manages an earnings beat.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 2.1 million call contracts traded on Wednesday, and 836,923 put contracts. The single-session equity put/call ratio fell to 0.39 and the 21-day moving average stayed at 0.41.

-

Walmart Inc (NYSE:WMT) stock is down 4.6% before the bell, after the blue-chip retailer reported fourth-quarter earnings of $1.39 per share, which is lower than the estimated $1.50. Though revenue and same-store sales came in better-than-expected, a cautious outlook dampened investor sentiment. Year-over-year, the equity is up 23% coming into today.

- The shares of Twilio Inc (NYSE:TWLO) are up 9.8% in electronic trading, after the software company reported a better-than-expected fourth-quarter earnings and revenue, as well as a strong forecast. In response, no fewer than 12 analysts raised their price targets on TWLO, and the stock is looking to head back up toward its record highs at the open.

- Marriott International Inc (NASDAQ:MAR) is down 0.3% ahead of the open this morning, despite the hotel giant eking out a fourth-quarter earnings beat. The hotel chain also reported a revenue miss, as the pandemic continued to weigh on the sector. Year-over-year, MAR is down 9.4%.

- Today's economic data flurry mostly occurs before the open.

Stocks Lower in Europe, Asia

Asian markets were mostly lower on Thursday, despite mainland Chinese stocks returning from the Lunar New Year holiday. The sole gainer was China’s Shanghai Composite, which added 0.6%. Pacing the laggards was Hong Kong’s Hang Seng, which fell 1.6%, followed by a 1.5% drop for the South Korean Kospi. Elsewhere, Japan’s Nikkei shaved 0.2%.

European markets aren’t much better off, shifting lower as corporate earnings reports from giants such as Airbus, Credit Suisse, and Nestle roll in. Investors are also keeping an eye on euro zone inflation data for January, and monitoring key economic data stateside. In response, the German DAX was last seen up 0.2%, while London’s FTSE 100 and France’s CAC 40 are down 0.6% and 0.2%, respectively.