Third-quarter GDP grew by 3.5%, on par with estimates

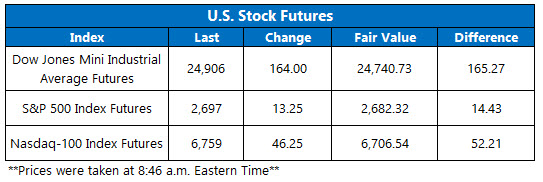

Dow Jones Industrial Average (DJIA) futures are more than 150 points higher, amid easing concerns about trade tensions with China. S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) futures are also confidently higher, powered by a rebound in the tech sector.

Investors are also eager to digest comments from Fed Chair Jerome Powell, who will speak at the Economic Club of New York later today. In addition, Wall Street will dissect the latest Fed meeting minutes for clues to the pace of future rate hikes. Meanwhile, the latest reading of third-quarter gross domestic product (GDP) showed 3.5% growth, unchanged from initial estimates.

Continue reading for more on today's market, including:

- This is the best time to buy stocks next month, per Schaeffer's Senior Quantitative Analyst Rocky White.

- It could be a long December for this Apple supplier.

- All signs point to a short squeeze for this solar stock.

- Plus, Goldman likes Alaska Air; Tiffany stock sinks after revenue miss; and Salesforce toasts an earnings beat.

5 Things You Need to Know Today

-

The Chicago Board Options Exchange (CBOE) saw 694,457 call contracts traded on Tuesday, compared to 487,038 put contracts. The single-session equity put/call ratio climbed to 0.70, and the 21-day moving average slid to 0.70.

- Alaska Air Group, Inc. (NYSE:ALK) stock is up 2.4% in electronic trading, after Goldman Sachs added the airliner to its "Conviction Buy List." In addition, three other brokerages issued price-target hikes, including to $84 at Cowen. This all comes after the company's upwardly revised fourth-quarter guidance yesterday. ALK is no stranger to bull notes from the analyst community, but still remains below its year-to-date breakeven level.

- One earnings casualty is Tiffany & Co. (NYSE:TIF), down 12.2% ahead of the bell, after the luxury name's third-quarter revenue and same-store sales fell short of estimates. TIF is now on track to breach its year-to-date breakeven level, and has dropped roughly 20% in the past three months. The stock could fall dangerously close to its Nov. 29, 2017, annual low of $90.55.

- One earnings winner is Salesforce.com, Inc. (NYSE:CRM), up 9.2% in electronic trading, after the software name reported third-quarter earnings and revenue that exceeded analyst expectations. No fewer than four brokerages have issued price-target hikes in response, including to $182 at RBC. CRM has been caught in the broad-market sell-off, but appears to have found support at its 320-day moving average.

-

Today will also feature data on MBA mortgage applications, international trade, new home sales, wholesale inventories, and the weekly crude inventory report from the Energy Information Administration (EIA). Box (BOX), Chico's (CHS), Dick's Sporting Goods (DKS), Guess (GES), and Tilly's (TLYS) will report earnings

Energy Stocks Boost Asia, Tech Stocks Lift Europe

It was a positive finish in Asia today. Hong Kong's Hang Seng outpaced its peers by adding 1.3% on strong days for energy names CNOOC and PetroChina. Rallying consumer stocks helped boost China's Shanghai Composite and Japan's Nikkei to 1% gains, while South Korea's Kospi tacked on 0.4%.

Most European markets are modestly higher at midday, with tech shares creating tailwinds. At last check, the French CAC 40 is up 0.2%, while the German DAX is flirting with a 0.04% lead. However, London's FTSE 100 is down 0.1% ahead of a Bank of England (BoE) Brexit report due later today, which will be followed by a press conference from BoE Governor Mark Carney.