The S&P 500 also logged its sixth straight monthly win

U.S. stocks finished mixed on the last day of the third quarter, led by a strong outing from energy stocks. However, it was not enough for the Dow and S&P 500 to eke out weekly wins. Both indexes did manage to finish September in the black, though, with the S&P logging its sixth straight monthly advance.

The Nasdaq, on the strength of a red-hot tech sector, scored a gain for the week, but could not avoid a monthly loss. All three benchmarks finished with gains for the third quarter, including the S&P 500's biggest quarterly advance since December 2013.

Continue reading for more on today's market, including:

- Put volume ramped up after Facebook's security breach.

- Analyst: Sell this shipping stock on trade concerns.

- Plus, a Stitch Fix earnings preview; another bull note for Nvidia; and a preview of what October could hold for stocks.

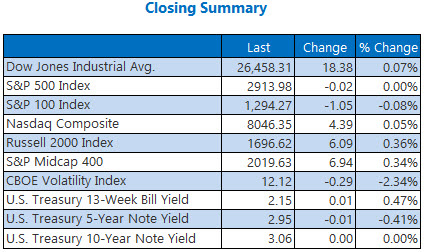

The Dow Jones Industrial Average (DJI - 26,458.31) finished up 18.4 points, or 0.07%. Of the 30 Dow components, 18 had a winning session, with Intel (INTC) taking the top spot with its 3.1% rise. DowDuPont (DWDP) paced the 12 losers for the second straight day, down 1.6% at the close. For the week, the Dow finished down 1.1%. It gained 1.9% for the month and 9% for the third quarter, though.

The S&P 500 Index (SPX - 2,913.98) shed 0.02 point today. For the week, it gave back 0.5%. For the month and quarter, it gained 0.4% and 7.2%, respectively. The Nasdaq Composite (IXIC - 8,046.35) gained 4.4 points, or 0.05%. It added 0.7% this week, but shed 0.8% for the month. It gained 7.1% in the third quarter.

The Cboe Volatility Index (VIX - 12.12) fell 0.3 point, or 2.3%. It nabbed a 3.8% win for the week, but shed 5.8% for the month and 24.7% for the quarter.

5 Items on our Radar Today

- Business services startup Slack, popular among companies for its chat capabilities, is preparing to go public early in 2019, according to a Wall Street Journal report. The service is a direct competitor to many big-cap tech stocks that offer chat features, such as Microsoft (MSFT), Alphabet (GOOGL), and Facebook (FB). (Wall Street Journal)

- Alphabet CEO Sundar Pichai has agreed to testify in front of the U.S. House Judiciary Committee later this year. Republicans on the House had expressed concerns that Google's search engine algorithms were influenced by human bias. (Reuters)

- Stitch Fix stock could make a big post-earnings move.

- One analyst set lofty goals for Nvidia stock.

- What to expect from stocks next month.

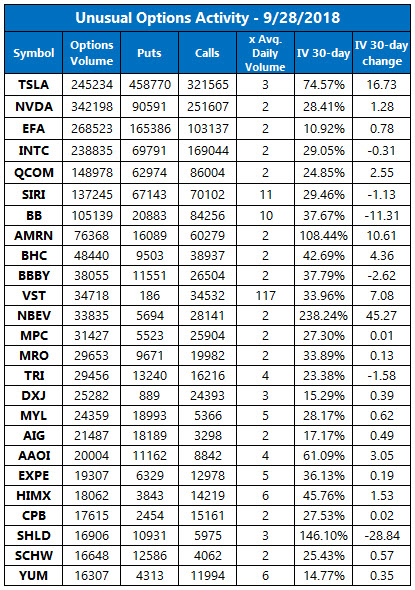

Data courtesy of Trade-Alert

Oil Stays Hot For Highest Close Since Late July

Oil climbed once more, after signs pointed to tightening global supply. November-dated crude futures added $1.13, or 1.6%, to settle at $73.25 per barrel -- its highest finish in three months. For the week, black gold gained 3.5%, and for the month, gained 4.9%. However, oil dipped 1.2% for the quarter.

Gold prices ended higher today, with December-dated gold futures closing up $8.80, or 0.7%, at $1,196.20 per ounce. For the week though, the precious metal shed 0.4%. It also gave back 0.9% for the month, its sixth straight monthly decline. For the third quarter, gold lost 4.6%.