The U.S. added a lower-than-expected 148,000 jobs last month

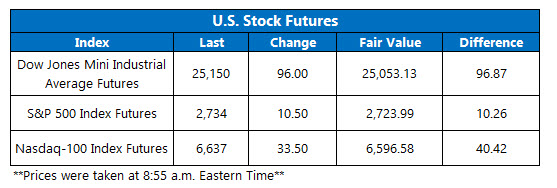

Jobs data will be in focus today, after the Labor Department said the U.S. economy added 148,000 jobs in December. Although this marked the slowest pace of job growth in three months -- and missed the consensus forecast for 198,000 new jobs -- stock futures are holding onto early gains, as wages increased slightly and the unemployment rate held at 4.1%. Another positive session would have the Dow Jones Industrial Average (DJI) extending its newfound lead over the 25,000 mark, and bring its daily win streak to four. Futures on the S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) are also trading above fair value, pointing to another record-setting day for U.S. stocks.

Continue reading for more on today's market, including:

5 Things You Need to Know Today

- The Chicago Board Options Exchange (CBOE) saw 1.3 million call contracts traded on Thursday -- the most since Nov. 29 -- compared to 646,239 put contracts. The single-session equity put/call ratio fell to 0.50, while the 21-day moving average stayed at 0.57.

- Apple Inc. (NASDAQ:AAPL) said that all of its devices -- including iPhones, iPads, and Macs -- have been affected by Intel (NASDAQ:INTC) chip flaws, known as Spectre and Meltdown, and will issue a patch for its Safari web browser within a few days. Separately, Billboard reported Jimmy Iovine is slated to step down from Apple Music in August. At last check, AAPL stock was up 0.4% in electronic trading.

- J.P. Morgan Securities upgraded Fiat Chrysler Automobiles NV (NYSE:FCAU) to "overweight" from "neutral," saying it expects increasing volume and stabilizing pricing power to buoy a bull market for auto stocks this year. U.S.-listed shares of FCAU stock are up 2.5% ahead of the bell, on track to open at an all-time peak.

- After surging nearly 700% on Thursday on the back of the internet ad specialist's blockchain deal, shares of ChinaNet Online Holdings, Inc. (NASDAQ:CNET) are down 9.7% in pre-market trading. Considering CNET stock's 14-day Relative Strength Index (RSI) closed last night at 96.56 -- deep into overbought territory -- a near-term pullback was likely in the cards.

- International trade data, factory orders, and the ISM non-manufacturing index will released today, while Constellation Brands (STZ) rounds out the week's earnings reports. Next week marks the start of fourth-quarter earnings season, with a number of big banks set to report.

Asian Stocks Finish Trading Week With Big Gains

The global stock market rally continued overnight, with Asian markets capping off a strong week with more gains. The Nikkei pushed further into 26-year-high territory, closing the session up 0.9%, boosted by blue chips like Sony and Toyota. Chinese shares also rose, with real estate stocks among the top performers. By the close, the Shanghai Composite was up 0.2% and Hong Kong's Hang Seng added 0.25%. In South Korea, the Kospi jumped 1.3%.

European shares are on the rise, too. In fact, the FTSE 100 is pacing for its highest close ever, last seen trading up 0.3%. Meanwhile, the German DAX was up 1.1%, and France's CAC 40 had added 0.8%. Automakers across the region are seeing heavy buying, a theme that's been consistent for most of the week. In economic news, consumer confidence in France rose in November, while eurozone inflation for December matched expectations.