The security offers a dividend yield of 2.42%

CVS Health Corp (NYSE:CVS) announced on Tuesday it will expand Project Health, the company's free, community-based health screening program, into two new areas, including Las Vegas and Richmond. Project Health will also add four new mobile units this year, and host dedicated events for children and seniors. In addition, the pharmacy retailer plans to host over 1,600 screening events in 45 markets in the U.S. and Puerto Rico.

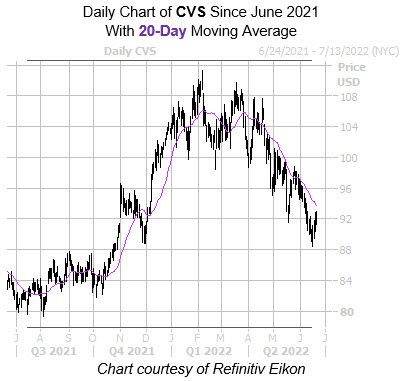

At last check, CVS is up 0.8% to trade at $92. The security has careened lower on the charts since hitting a Feb. 8, roughly seven-year high of $111.25. The shares now seem to be running into resistance at the $93 level, following its June 17 annual low of $88.42, while being pressured lower by the 20-day moving average. Year-over year, though, the stock is up 9.9%.

At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), CVS sports a 10-day put/call volume ratio of 1.52 that stands higher than all but 1% of readings from the past year. This means puts have been getting picked up at a much quicker-than-usual clip over the past two weeks.

The healthcare company has only generated 2.6% in revenue growth, and 1.1% in net income growth since 2021, with estimates suggesting CVS will end 2022 with a 5.7% increase in revenues, in addition to a 0.5% decrease in earnings. As a result, CVS Health stock’s growth potential appears to be limited from this perspective.

Nonetheless, CVS provides an intriguing option for value investors at a forward price-earnings ratio of 10.89, and a price-sales ratio of 0.40. CVS Health stock also offers a dividend yield of 2.42%, with a forward dividend of $2.20, making the long-term reward potential more attractive.

It's also worth noting CVS is expected to grow revenues and earnings 4.3% and 7.3%, respectively, in 2023. This points to significant improvement from its 2022 bottom line expectations.