The sentiment backdrop favors an SPX breakout, even as the index trades near the top of its range

"...the SPX enters options expiration week just below another layer of historical resistance: the round 3,000 millennium mark, which is just below the SPX's 20% year-to-date (YTD) gain at 3,008. Bonds, as represented by the iShares 20+ Year Treasury Bond ETF (TLT - 140.44), experienced a sharp retreat from the round 20% YTD level last week, amid a rotation out of bonds into stocks.

"...It would take a decline below the put-heavy 290 strike to put delta-hedge selling in play. Meanwhile, big call open interest resides at the 300 strike, equivalent to SPX 3,000, and premium sellers will work to defend a move above this level. This was evident late Friday, as the SPX sold off in the last 15 minutes of trading after sniffing the 3,000 area. Most of this open interest was bought to open at the 300 strike..."

-- Monday Morning Outlook, October 14, 2019

Standard October options expiration week has come and gone amid more macro headlines -- China looking for more talks before signing on to whatever was agreed to earlier this month, plus a deal between the European Union (EU) and Great Britain regarding Brexit that now faces a delay after a weekend session of parliament. Company-specific earnings-related news came in, as well, with many financials getting the earnings season started with overall positive reactions.

The good news is that stocks were able to advance, but the call-heavy SPDR S&P 500 ETF Trust (SPY - 297.97) 300 strike, which equates to S&P 500 Index (SPX - 2,986.20) 3,000, proved to be a formidable resistance area as expiration approached, which I raised as a possibility last week.

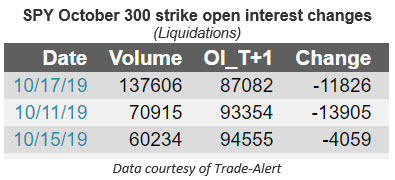

Volume was heavy at this strike throughout the week, but the bulls were fighting net liquidations on a few days -- which became a coincident headwind as hedged long S&P futures positions associated with these calls were sold as the positions were liquidated. And on expiration day, with the SPY languishing below the 300 strike, bulls were fighting a steady liquidation of long S&P futures positions used as a hedge to the remaining 300-strike calls that were set to expire.

The SPX's intraday high last week was at 3,008.29, a number that I discussed in last week's report as a potential problem area, since it is 20% above the 2018 close. A theme this year has been selling off assets that approach such year-to-date (YTD) percentage gains -- like we've seen with bonds, as represented by the iShares 20+ Year Treasury Bond ETF (TLT - 139.58) at the beginning of the month; gold, as represented by the SPDR Gold Shares (GLD - 140.46) in early September; and the SPX on two previous occasions this year.

"A couple of factors that could be supportive of stocks in the weeks ahead is the contrarian implications of low earnings expectations as we move into earnings season. And, since late April, when the SPX was trading around 2,950, short interest on SPX component stocks is up nearly 11%."

-- Monday Morning Outlook, October 14, 2019

"A survey of 230 fund managers who oversee $620 billion in assets showed that many investors view the U.S.'s continuing trade war with China as the biggest risk to the market... Cash levels among fund managers rose to 5% from 4.7% last month, pushing further above the 10-year average of 4.6%."

-- The Wall Street Journal, October 15, 2019

"Corporate profits are estimated to have shrunk by 4.6% for the third quarter from a year earlier, according to a FactSet consensus of analysts' estimates. Of the 75 companies to report so far, earnings are down 4.8% from a year earlier... Companies, especially multinationals, have been blaming the dollar for hurting profit margins all year. A stronger dollar generally makes U.S. products less competitive overseas and raises the costs of converting foreign revenue back into local currency. "

-- The Wall Street Journal, October 18, 2019

Even though the SPX failed at resistance levels last week, I still see growing potential for a breakout. First, the headwind of an options-related call ceiling disappeared last Friday with October options expiration. Additionally, looking ahead to November standard expiration, it appears the major SPY call open interest is at the 305 strike, equivalent to SPX 3,050. In other words, as it stands now, the SPY call open interest ceiling is higher.

Moreover, as I said last week, the sentiment backdrop appears to be on the side of the bulls, beginning with the short-covering potential amid low earnings expectations that I discussed last week. Furthermore, fund manager cash positions are above average, even with the SPX knocking on the door of a new all-time high. A strong dollar last quarter has been blamed for a third-quarter earnings headwind -- but this may be viewed as a tailwind for next quarter. And in fact, fund managers may look to deploy cash into stocks if the weaker dollar we have seen this quarter remains weak, and potentially supportive in the final quarter of the year.

There is another sentiment factor potentially supporting a breakout. Even as the SPX has rallied strongly from the lows earlier this month, note that the 10-day, equity-only, buy-to-open put/call volume ratio has not declined significantly like it has tended to do during other rallies. In other words, the ratio remains elevated relative to last month's low that preceded a pullback in equities to start the month. Pessimism among equity option buyers that built up during the last pullback looks to have peaked, and a gradual unwinding of this negative sentiment that pushes the ratio back to historical lows would likely occur within the context of a SPX breakout to new highs.

If the SPX pushes above its former highs, it would be a breakout from a bullish ascending triangle pattern, with the implication being a rally of almost 10% during the next four months. The biggest short-term risk is that the SPX has not yet broken out, and is therefore sitting nearer the top of its range. If you are bullish now, you're betting on a breakout -- but you do have sentiment factors supporting you.

Todd Salamone is Schaeffer's Senior V.P. of Research.

Continue reading: