A look at two historical underperformers with attractively priced options

Stocks are off to a rough start in October, as lackluster economic data spooks investors. What's more, several stocks could be in for a rough month, or quarter, if recent history is any indicator. Among the worst stocks to own in October and the fourth quarter, respectively, are semiconductor concern Advanced Micro Devices, Inc. (NASDAQ:AMD) and athletic apparel retailer Under Armour Inc (NYSE:UAA).

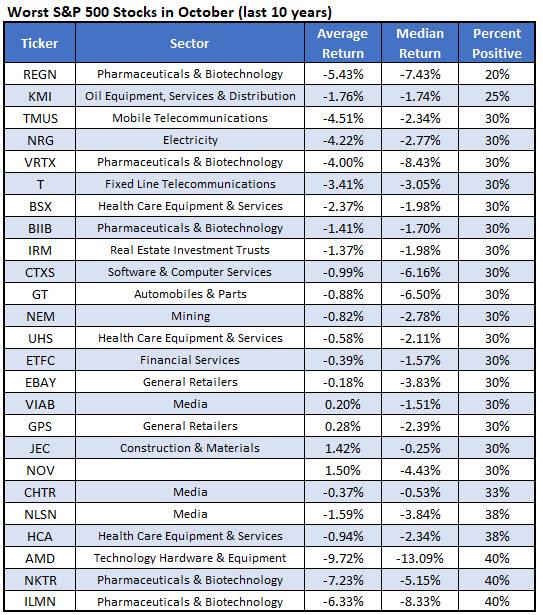

AMD Averages Steep October Losses

Below are the 25 worst S&P 500 Index (SPX) components to own in October, looking back 10 years, with data courtesy of Schaeffer's Senior Quantitative Analyst Rocky White. While AMD has ended the month higher 40% of the time, the stock has averaged a loss of 9.72% in the month -- by far the steepest on the list.

Advanced Micro Devices stock has given up 19% since touching a decade-plus high of $35.55 in early August, last seen trading at $28.82. The equity is now testing support in the $28 area, which contained its pullback over the summer. This region also represents a roughly 50% year-to-date gain for AMD shares, and is in the vicinity of its 160-day moving average. Of course, while AMD's short-term trajectory could be determined by U.S.-China trade talks, another 9.72% drop in October would put the shares well below potential support, down near $26.45.

Despite the security's pullback over the past couple of months, AMD option buyers have rarely been more bullish. On the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day call/put volume ratio of 5.16 indicates traders have bought to open more than five AMD calls for every put in the past two weeks. This ratio sits at the very top of its 12-month range. In the event of another October slide, an unwinding of optimism among options traders could exacerbate selling pressure on the semiconductor concern.

Meanwhile, traders looking to speculate on AMD's short-term trajectory should consider buying options. The equity's Schaeffer's Volatility Index (SVI) of 49% is higher than just 13% of all other readings from the past year, suggesting near-term option contracts are attractively priced at the moment, from a historical volatility standpoint.

UAA Stock Tends to Slide in Q4

Moving on, Under Armour topped White's list of the worst SPX stocks to own in the fourth quarter, looking back a decade. UAA is one of only four stocks with a win rate of just 30%, and has averaged a quarterly loss of 4.79%.

UAA shares suffered a massive post-earnings bear gap in late July. The equity subsequently fell near its year-to-date breakeven level, and its September rebound attempt was stopped short at its formerly supportive 200-day moving average. At last look, UAA stock was trading at $19.33; another 4.79% retreat would put the security back near $18.40 to start 2020.

Should the athletic apparel concern once again flounder in the fourth quarter -- perhaps in the wake of another earnings disappointment, with quarterly figures due in early November -- several short sellers could cheer. Short interest accounts for more than 20% of Under Armour's total available float.

Meanwhile, as with AMD, now is an opportune time to purchase UAA's short-term options on the cheap. The equity's SVI of 38% is higher than just 14% of all other readings from the past 52-weeks.