"In 2014, the SPX was rejected at 2,000, and a near-7% correction ensued over the next month. Ultimately, the historically significant, but unpopular, 320-day moving average marked an important bottom. And if the mid-August 2019 closing low at 2,840 marks a low, the pullback from closing high to closing low would be about 6%, with the bottom occurring at the significant, but unpopular, 160-day moving average…

[I]f 2019 continues to 'rhyme' with 2014, you can make a sentiment case for at least a retest, and quite possibly a breakout above 3,000…

[N]ote that the 10-day, equity-only, buy-to-open put/call volume ratio recently peaked around two-year highs, and is declining. Historically, this has been a short-term buy signal."

--Monday Morning Outlook, September 3, 2019

At the start of this month, per the excerpt above, I drew comparisons between the S&P 500 Index’s (SPX - 3,007.39) price action five years ago with that of the present. And just two weeks later, the SPX has indeed rallied back to the 3,000 millennium area. Last week's advance was driven by U.S.-China trade headlines again, as increased tariffs set to go in effect on Oct. 1 were pushed back to Oct. 15, and negotiations on a trade deal are set to resume again. Moreover, China exempted certain U.S. exports from its tariff list, including some agriculture products, which is one of several demands by the U.S. during these negotiations.

That said, nothing is finalized on the trade front, but last week's "goodwill" gestures were enough to spur buyers of equities. Bonds, gold, and this year's outperformers retreated, with investors rotating into 2019 underperformers, such as small-caps and financials. Unfortunately, the broad-market price action will continue to be driven by trade headlines in the coming weeks, as negotiations continue.

In addition, other crucial uncertainties are looming with respect to the Federal Open Market Committee (FOMC) meeting this week, as well as Brexit uncertainty. Speaking of Europe, the European Central Bank (ECB) lowered rates again last week, as its top central bankers preached fiscal stimulus to member countries after a long period of guiding toward structural reforms, including fiscal discipline.

"Resistance is close overhead, with the psychologically important 3,000 millennium area in the vicinity of the round 20% SPX year-to-date gain (3,008), as well as the 3,013 close the day prior to the Fed cutting rates on July 31."

--Monday Morning Outlook, September 9, 2019

With last week's theme being a perception of progress in macro uncertainties looming over the market, such issues remain unresolved. And amid the continued domestic and global uncertainties, the SPX enters September standard expiration week around its late-July all-time high, which is just above the psychologically important 3,000 millennium level and an area that I mentioned as important last week; specifically, between 3,008 and 3,013, per the except from last week's commentary immediately above.

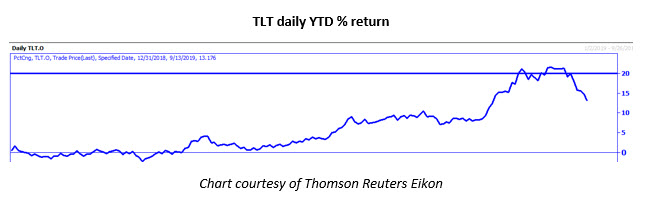

In fact, during the past couple of weeks, I find it interesting that both the SPDR Gold Shares (GLD - 140.15) exchange-traded fund (ETF) and iShares 20+ Year Treasury Bond ETF (TLT - 136.54) met a similar fate as the SPX beginning in late July after venturing into their respective 20% year-to-date zones, per the graphs immediately below.

SPX, GLD, TLT -- 20% YTD return resistance (thick horizontal line)

The takeaway is that a current risk to equity investors is this year's pattern of taking profits when key asset benchmarks reach levels that correspond to a 20% profit for 2019. If this pattern repeats, you will see a rotation out of stocks, and into bonds and gold. Another pattern that has held up in 2019 is the SPX finding support on pullbacks at its year-over-year breakeven level. So, if there is a major pullback, the 2,915-2,930 area should hold on pullbacks, based on where the SPX was trading one year ago this coming Friday and into month's end.

In fact, those who sold call options on the SPDR S&P 500 ETF Trust (SPY - 301.09) would like to see selling predominate this week, ahead of Friday's expiration. Peak call open interest for SPY is sitting at the 300 strike, which equates to roughly SPX 3,000. Call open interest is high relative to put open interest at strikes down to 296, or SPX 2,960.

Could Thursday's SPY doji candle be a prelude to a decline below peak call open interest at the 300 strike by Friday? This is something we'll be watching through the course of the week, as the SPY does battle with its July highs, where profit-taking began as U.S.-China trade relations started souring again.

I don't see a huge risk of options exacerbating a sell-off if negative news hits the market this week. Big put strikes are far below the SPY's closing Friday price, which means a delta-hedging sell-off related to big put open interest strikes acting as magnets is highly unlikely. And while call open interest predominates at strikes in the immediate vicinity of the SPY, the absolute number of contracts at these strikes is not at levels that we typically see at big put strikes -- which means sell-offs due to an unwind of long positions related to the call open interest won't be as impactful.

On the sentiment front, one thing that has changed significantly from last week is the level of the 10-day, equity-only, buy-to-open put/call volume ratio. This ratio has declined and is now close to levels that have marked previous tops for the equity market during the past year, which I find interesting, as the SPX trades at an area at which it peaked in late July.

When this ratio is declining, it is good news for bulls. But the risk now is a subsequent turn higher in this ratio from extreme lows, as it is usually a catalyst that suddenly changes the mindset of equity option buyers. With a Fed meeting looming and trade negotiations with China set to start again, beware that indicators like this suggest that market participants are less prepared for negative news, implying correction risk has grown.

The good news is that in the absence of negative headlines, this ratio -- while low -- still has room to decline to the 2018 lows. This would likely coincide with an SPX breakout clearly above the July highs, which would be ironic, as it has been well-publicized that September is historically the worst month for equity returns.

Short-term risks have increased, from a chart perspective, amid growing optimism among equity option buyers. But bulls should be encouraged by the recent surge in SPX component short interest alongside the rally in stocks. In fact, SPX component short interest is up almost 4.5% in 2019, and more than 10% from its low at the end of April.

The most recent short interest data is as of the end of August, when the SPX was just 2% below its all-time high. If such a build from a multi-year low level was concurrent with the SPX breaking below long-term support levels, it would raise caution flags, as the shorts are in control and more apt to short counter-rallies. But for now, this growth in short interest amid a strong technical backdrop can be construed as bullish, implying pullbacks should continue to be bought.

Finally, on the volatility front, I am monitoring option buyers on Cboe Volatility Index (VIX - 13.74) futures closely. A couple of weeks ago, after the VIX had experienced a couple of "aftershock" type advances following its early August peak, I noted how the 20-day ratio of VIX call buying relative to put buying was on a downward trajectory, with the takeaway being that volatility was likely heading lower.

I forecast the decline in volatility because a heavy dose of VIX call buying relative to put buying preceded the last couple of VIX spikes. In fact, when call buying relative to put buying on the VIX hit a ratio of 5-to-1, the lead time before the VIX spikes was a few days to a few weeks.

I bring this up because since the end of August, the ratio of VIX call buying to put buying has risen from 2.42 to 3.63. While not yet at an alarming level, it is something I am monitoring and will follow up on via Twitter or in this market commentary next week.

If the VIX trades into the 12 handle, which has defined a floor for the volatility index this year, the purchase of VIX calls or SPY puts should be considered to hedge a long equity portfolio or speculate on another short-term decline for stocks.

Todd Salamone is Schaeffer's Senior V.P. of Research.

Continue reading: