A pair of retail stocks could struggle in the short term

We recently outlined the best stocks to own in January and the first quarter, historically. Today, we'll take a look at stocks that could struggle in the short-term, if past is prologue. Among some of the worst January stocks is luxury retailer Tiffany & Co. (NYSE:TIF), while Victoria's Secret parent L Brands Inc (NYSE:LB) has been among the worst stocks to own in the first quarter.

Below are the 25 worst S&P 500 Index (SPX) stocks in January, looking back 10 years, courtesy of Schaeffer's Senior Quantitative Analyst Rocky White. In order to make the cut, securities had to have at least eight years' worth of data. LB stock sports the biggest average monthly loss of 6.39%. TIF has also racked up one of the steepest average January losses, at around 5.5%. Both equities have ended the month higher just 30% of the time.

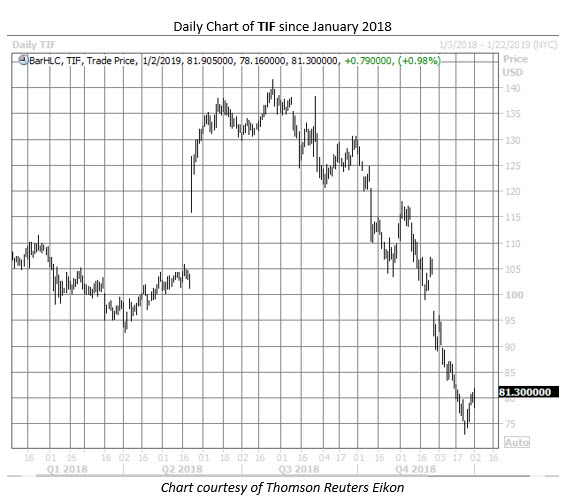

Tiffany shares ended 2018 with a loss of nearly 23%, touching a two-year low of $73.04 on Monday, Dec. 24. What's more, it was TIF's worst quarter since September 2002, with the stock dropping nearly 38%. The shares were already in free-fall mode after peaking above $141 in late July, and a post-earnings bear gap in late November only exacerbated the selling pressure. Now, TIF is trading around $81.30. Another 5.5% drop this month would place the shares around $76.82.

Despite the equity's underperformance of late, several analysts remain devoted to TIF. In fact, half of the 14 brokerage firms following the shares maintain "strong buy" opinions, with not a "sell" in sight. Should the stock extend its recent slump and once again fall flat in January, a round of downgrades could act as additional headwinds for Tiffany.

As alluded to earlier, L Brands has emerged as not only a historical January laggard, but also tends to struggle in the entire first quarter. Below are the 25 worst stocks to own in the first quarter, looking back 10 years. LB has averaged a quarterly loss of 3.72%, with a win rate of just 40%. However, that's less than the stock's average January loss, suggesting LB tends to drop out of the New Year's gate, but pare its losses in February and March.

LB just wrapped up its worst year ever, dropping a whopping 57.4% in 2018. The stock also gapped lower in November, after the company cut its full-year forecast and announced a CEO shift at its struggling Victoria's Secret unit. Rebound attempts were capped at LB's 200-day moving average, and the shares eventually went on to hit an eight-year low of $23.71 on Dec. 24. The security was last seen trading at $26.26. Another 6.4% loss this month would place the retail stock around $24.57.

Near-term options traders remain more call-biased than usual, though. LB's Schaeffer's put/call open interest ratio (SOIR) of 0.64 is in the 20th percentile of its annual range. While peak open interest sits at the deep out-of-the-money January 60 call -- suggesting some of those positions may have been opened as LEAPS before LB's demise -- the overhead January 30 strike is runner-up, with nearly 8,600 contracts outstanding. This could serve as a short-term layer of round-number resistance for the shares.