Call traders have been targeting the stock at their fastest rate all year

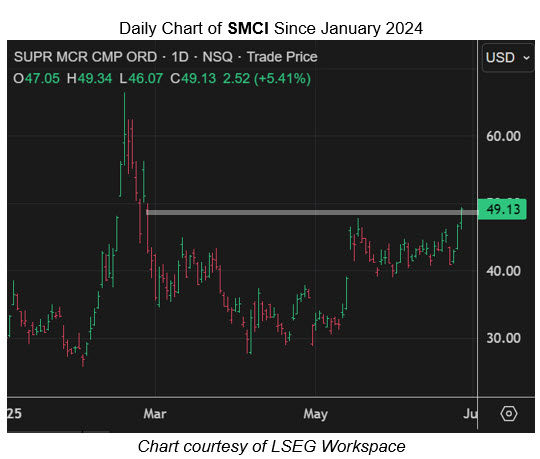

Super Micro Computer Inc (NASDAQ:SMCI) stock was last seen 5.4% higher to trade at $49.14, brushing off Keybanc's new "sector weight" rating, with the analyst in question highlighting competitive pressure in the artificial intelligence (AI) space. The company also announced plans to issue $2 billion in convertible notes earlier this week.

SMCI is seeing the most options volume in the options pits today, with 609,000 calls and 131,000 puts traded at last glance, which is triple the intraday average volume. The most popular contract by a long shot is the weekly 6/27 50-strike call, where new positions are being opened.

Options traders have been much more bullish than usual of late. This is per the stock's 50-day call/put volume ratio of 2.85 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which ranks higher than all other readings from the past year.

These options are looking quite affordable. Super Micro Computer stock's Schaeffer's Volatility Index (SVI) of 69% sits in the 5th percentile of its annual range, indicating options traders are now pricing in low volatility expectations. Plus, its Schaeffer’s Volatility Scorecard (SVS) score of 83 out of 100 indicates the equity has historically delivered larger-than-expected price swings.

The shares are on track for their fifth gain in the last six sessions, as well as their third consecutive pop. Despite a steep 40.9% year-over-year deficit, the equity already rose 61.1% in 2025, and is today looking to close above the $50 level for the first time since February.