Our traders predicted KB Home stock's May rally

Subscribers to Schaeffer's Options Under $5 more than doubled their money with our KB Home (NYSE:KBH) May 33 call. Below, we'll unpack the drivers that inspired this bullish bet.

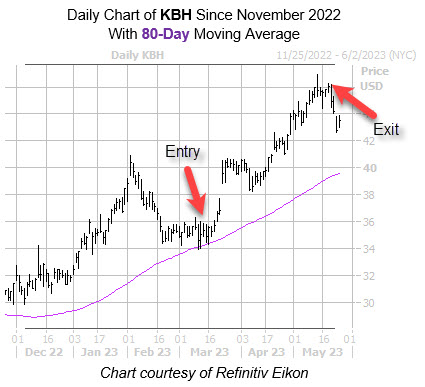

At the time of our recommendation on March 13, KB Home stock boasted a 9% year-to-date lead, and was testing a floor at the $34.50 level after cooling from a rally to the $40 level in February. Shares also boasted support from their 80-day moving average.

Nevertheless, short-term options traders leaned bearish, per the stock's Schaeffer's put/call open interest ratio (SOIR) of 5.36, which ranked higher than 95% of readings from the past year. This suggested an unwinding of pessimism had the potential to create tailwinds for the shares.

Shorts were firmly in control, too, given the 7% of the equity's available float was sold short. This is often interpreted as a bullish signal, as it points to pent-up buying pressure.

KB Home stock broke above resistance at the $22 region in late March, and after a short breather in April continued to rally until reaching a May 12, one-year peak of $46.91. We partially closed the position on April 20, and fully closed it on May 18, with subscribers averaging a 161% profit.