A short position on Tesla netted bearish traders a 120% profit

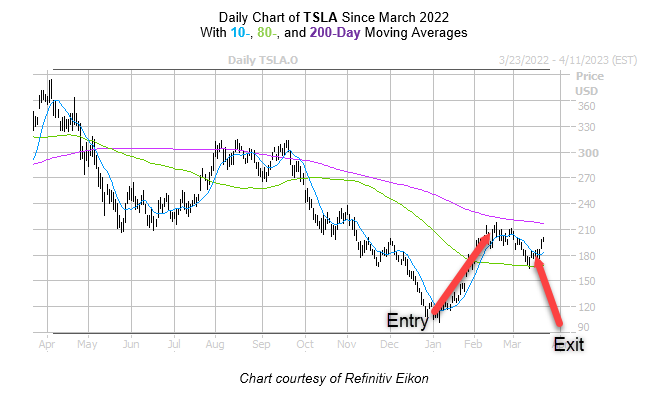

Last week, subscribers to our Vertical Options Trader service scored a net profit of 120% on our recommended Tesla Inc (NASDAQ:TSLA) March 17, 190- and 170-strike put spread. Below, we'll unpack the reasoning for the bearish stance on the electric vehicle (EV) giant. This trade was recommended on Friday, Feb. 17.

On Thursday, Feb. 16, TSLA had recently peaked just shy of its 200-day moving average, before declining 7% into the close. While retreating, the equity moved below half its all-time high and twice its Jan. 6 annual low of $101.81.

We expected Tesla stock to break below support at its 10-move average near the $200 area, followed by a pullback toward the 80-day trendline near $170.

Today, TSLA is inching higher, last seen up 0.2% to trade at $198.04, following yesterday's news that Moody upgraded the shares to Baa3 rating from its junk-rated credit. The analyst noted the EV maker's prudent financial policy and operational track record. Year-to-date, Tesla stock is 60.7% higher.