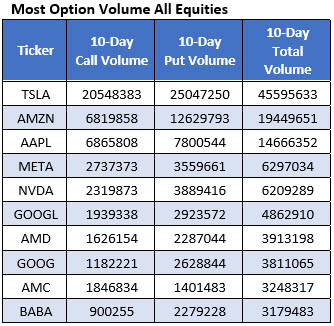

Tesla stock topped our list of stocks with the most options volume over the past 10 days

There has been no shortage of news surrounding electric vehicle (EV) giant Tesla Inc (NASDAQ:TSLA), considering Elon Musk's Twitter (TWTR) endeavors and Tesla's negative price action on the charts. Now, as TSLA looks to close its worst performing year on record, we're taking a look at the recent options activity surrounding the stock.

Tesla stock topped Schaeffer's Senior Quantitative Analyst Rocky White's list of names that have attracted the most options volume over the past 10 days. In that time period, 20,548,383 calls and 25,047,250 puts were exchanged. The most popular contract during this time was the December 150 put, followed by the weekly 12/23 125-strike call. It's also worth noting that eight of the top 10 open interest positions were calls.

The options activity over these past couple weeks indicates a bearish shift amidst the stock's slide, as TSLA's 50-day call/put volume ratio of 1.23 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks higher than 98% of readings from the past year.