Options volume has ticked up for GME over the last two weeks

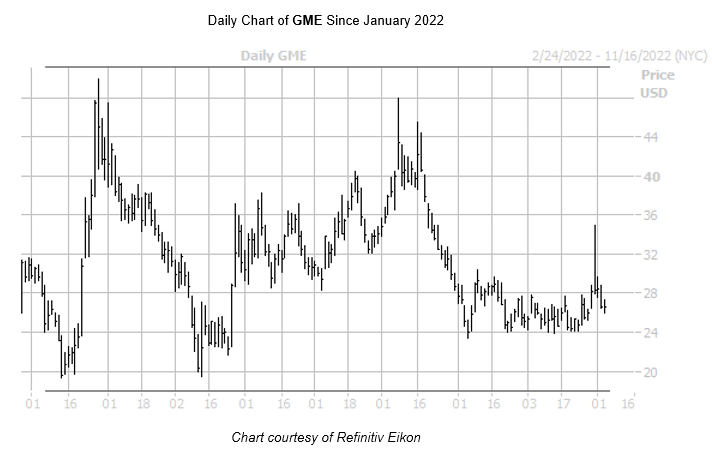

The shares of GameStop Corp. (NYSE:GME) are marginally lower this afternoon, down 0.5% at $26.88, as they continue to dawdle after Monday's rally attempt. GameStop stock was up more than 24% at its session highs on Oct. 31, before the $35 level rejected the shares, which closed at $28.31. It looks as though the $27 region is moving back in as a ceiling, while GME carries a more than 51% year-to-date deficit.

Amid this wild price action, GME saw an uptick in interest in its options pits. The equity managed to land at the number one spot on Schaeffer's Senior Quantitative Analyst Rocky White's list of S&P 400 (SP400) stocks that have attracted the highest weekly options volume during the past two weeks. With 1,625,910 calls and 448,301 puts exchanged over the last two weeks, the most popular contract by far was the weekly 10/28 30-strike call.

More broadly, this penchant for bullish bets is nothing new. This is per GME's 50-day call/put volume ratio of 2.60 over at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio ranks in the elevated 89th percentile of its annual range, implying a preference for calls in the last 10 weeks.

For those wanting to join in on the fun, now could be the ideal time. GameStop stock's Schaeffer's Volatility Index (SVI) of 98% sits in the 22nd percentile of its annual range, suggesting options traders are pricing in low volatility expectations right now. Plus, its Schaeffer's Volatility Scorecard (SVS) reading of 86 out of 100 means the security tends to outperform said volatility expectations.

Short sellers remain firmly in control, with short interest up 8.8% in the last two reporting periods. The 53.88 million shares sold short make up 21% of the stock's available float, or nearly two weeks' worth of pent-up buying power.