The stock has seen a surge in options volume during the past two weeks

The shares of Palantir Technologies Inc (NYSE:PLTR) have been middling on the charts since a post-earnings pop broke the equity above the 50-day moving average earlier this month -- a trendline that quickly turned into close support. At last check, PLTR was up 3% to trade at $24.73.

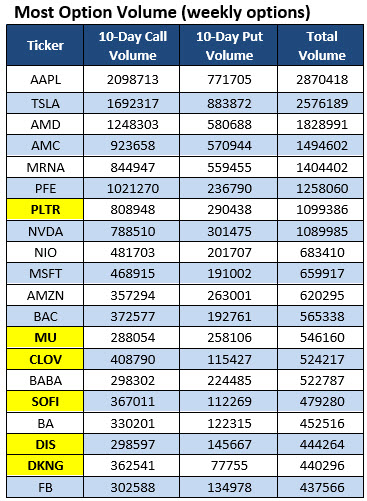

During this time, Palantir stock landed on Schaeffer's Senior Quantitative Analyst Rocky White's list of stocks that have attracted the highest weekly options volume within the past two weeks, with new names added to the list highlighted in yellow. Specifically, 808,948 weekly calls and 290,438 weekly puts have been exchanged during this time. The most popular contract during that two-week period was the weekly 8/13 25-strike call.

Of the four analysts in coverage, one carries a "strong buy" rating on Palantir stock, with one a "hold," and two a "strong sell." Meanwhile, the 12-month consensus price target of $24.61 is in line with current levels.

Now could be a good time to weigh in on the security's next move with options. The stock is seeing attractively priced premiums at the moment, per PLTR's Schaeffer's Volatility Index (SVI) of 46%, which sits in the 2nd percentile of its annual range.