More than 1 million calls have crossed the tape over the past 10 days

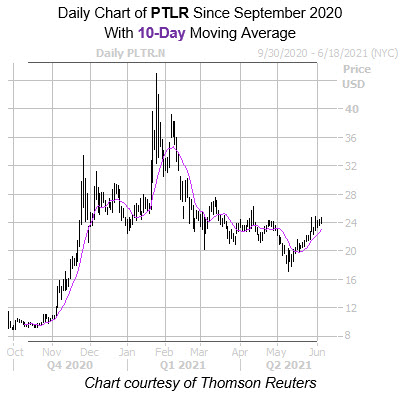

The shares of software name Palantir Technologies Inc (NYSE:PLTR) are up 1.6% to trade at $24.42 at last check. The equity has been trading mostly sideways since March, after cooling off from a Jan. 27, all-time high of $45, which is more than four times its initial public offering (IPO) price of $10. Shares regained support at the 10-day moving average in mid-May, and over the last month have added 24.4%.

Additionally, the security recently appeared on Schaeffer's Senior Quantitative Analyst Rocky White's list of stocks that have attracted the highest weekly options volume within the last two weeks. In Palantir Technologies stock's case,1,247,258 weekly calls and 296,645 weekly puts have crossed the tape during this time.

The brokerage bunch is pessimistic towards Palantir Technologies stock, with three of the four in question carrying a tepid "hold" or worse rating, while only one said "strong buy." Plus, the 12-month consensus target price of $22.43 is an 8.7% discount to the stock's current perch. This leaves ample room for price-target hikes and/or upgrades going forward, which could push shares higher.

Lastly, the equity looks ripe for a short squeeze. Short interest is up 53.5% in the last two reporting periods, and the 85.27 million shares sold short make up 6.1% of PLTR's available float.