Disney took a hit after its May 14 earnings, thanks to disappointing subscriber growth for its Disney+ streaming service

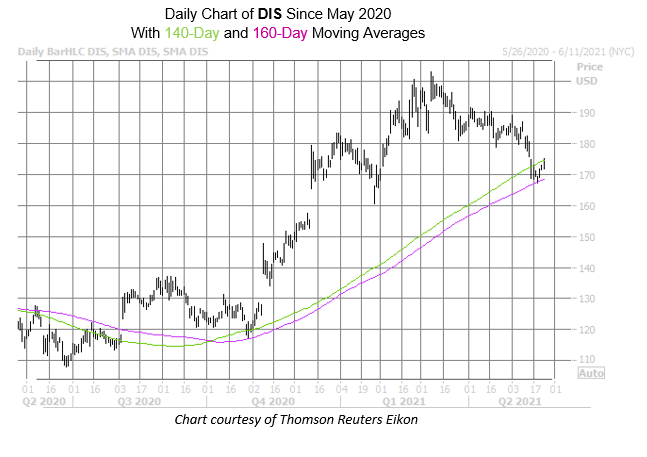

Walt Disney Co. (NYSE:DIS) reported earnings a little over a week ago, after the close on Thursday, May 14. The firm's earnings and revenue bested forecasts, but a Disney+ subscriber miss ultimately sunk the stock. The equity's 160-day moving average wound up containing most of this post-earnings carnage by mid-week last week, and today, DIS is up 1.6% at $174.44, though its next obstacle will be reclaiming its 140-day moving average. Below, we'll parse through some of the option activity that went down around Disney's fiscal second-quarter report, as well as the best way to play the Blue Chip now that earnings are in the rearview.

Amid all the earnings excitement, Disney stock popped up on Schaeffer's Senior Quantitative Analyst Rocky White's list of stocks that attracted the most option volume during the past 10 days, with names highlighted in yellow new to the list. According to White, 196,108 calls and 142,295 puts were exchanged. The most popular contract during this period was the May 175 call, followed by the 172.50 call in the same series. The most popular put during this period was the May 170 contract.

Calls are still slightly outnumbering puts today, and at last check, 36,000 calls and 21,000 puts were exchanged. The weekly 5/28 175-strike call is the most popular, followed by the June 180 call, with positions being opened at the former. This suggests these traders are pricing in more upside for for the underlying stock by the time of these contracts' respective expiration dates.

It looks like option bears ramped up their activity during this time period. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), DIS sports a 10-day put/call volume ratio that stands just below the top quartile of its annual range, suggesting puts are being picked up at a much quicker-than-usual clip.

Analysts remain hopeful for DIS. Of the 18 in coverage, 17 call it a "buy" or better, compared to one "hold" rating. Meanwhile, the 12-month consensus price target of $299.44 is a 42.6% premium to current levels.

With a post-earnings volatility crush coming into play, now might be the perfect time to speculate on Disney stock's next move with options. The security's Schaeffer's Volatility Index (SVI) of 23% sits in the lowest possible percentile of its 12-month range. This means option players are pricing in lower volatility expectations than they have all year. Plus, the security's Schaeffer's Volatility Scorecard (SVS) ranks at 80 out of a possible 100, implying the stock tends to outperform these volatility expectations -- a good thing for option buyers.