Call volume is running at double the average intraday amount

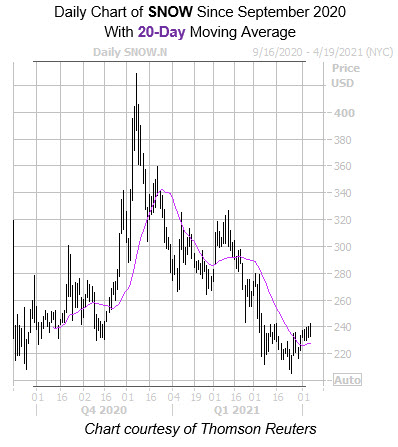

Cloud computing name Snowflake Inc (NYSE:SNOW) is higher today, up 0.4% to trade at $235.35 this afternoon. Though a catalyst for the positive price action remains unclear, the security has recently bounced off its $205.07 bottom, and reconquered support at the 20-day moving average. This comes after several bear gaps knocked off SNOW from a Dec. 8, all-time high of $429, which is more than three times its initial public offering (IPO) price.

Options bulls are blasting the equity today, with calls running twice over what is typically seen at this point. Specifically, the security has seen 59,000 calls, and over 8,000 puts cross the tape. The most popular contract is the weekly 4/9 245-strike call, followed by the monthly April 250 call, with new positions being opened at both.

On the analyst front, there is some hesitancy. Fourteen of the 24 in coverage sport a "hold" or worse rating, while the remainder say "strong buy." Meanwhile, the stock's 12-month consensus price target of $302.88 is a significant 28.8% premium to current levels.