Kroger stock is set to double before reaching an area that could act as a magnet

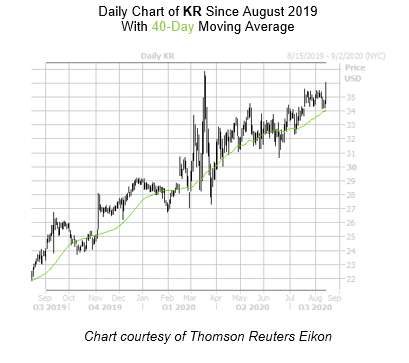

Grocery store concern Kroger Co (NYSE:KR) just saw its mid-August pullback contained by the 40-day moving average. Meanwhile, the $39-$40 areas -- with the stock's all-time-high sitting just above -- are double KR's 2017 closing low. That area could potentially act as a magnet on the charts, with the option set to double before reaching the $39 level. With the stock up 22% year-to-date and 59% year-over-year, it’s looking like the perfect time to buy calls on KR.

Despite this impressive price action, short interest has more than doubled since March. The 57.01 million shares sold short account for 7.4% of the stock’s available float. In other words, it would take nearly six days to cover these bearish bets at Kroger’s average pace of trading. Should some of this pent-up pessimism begin to unwind, shorts covering their bearish bets could provide additional tailwinds for Kroger stock.

Looking at analyst sentiment, of the 16 in coverage, 10 rate the equity a tepid "hold," while one more recommends a "strong sell. " With just five "buys" ratings on the books, there remains plenty of room for upgrades going forward.

Digging deeper, a large number of KR’s 36-strike calls are set to expire next week, which removes potential options-related resistance. Plus, the equity's Schaeffer's Volatility Index (SVI) of 22% stands higher than just 3% of all other readings from the past 12 months, implying near-term option traders are pricing in extremely low volatility expectations.

Subscribers to Schaeffer's Weekend Trader options recommendation service received this KR commentary on Sunday night, along with a detailed options trade recommendation -- including complete entry and exit parameters. Learn more about why Weekend Trader is one of our most popular options trading services.