Lululemon Athletica is flashing a bullish signal that, in combination with its latest peak, could push the equity higher

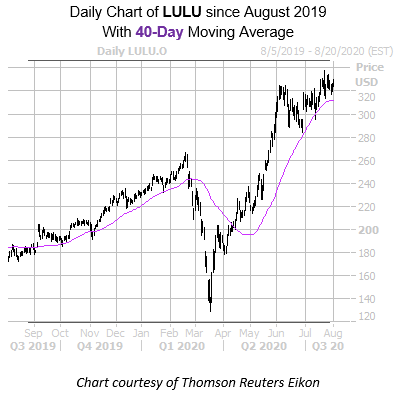

The shares of Lululemon Athletica Inc (NASDAQ: LULU) are up 0.8% to trade at $328.34 this afternoon, enjoying a 83.2% year-over-year lead, with support from the 40-day moving average. More upside may be on the horizon, too, as its recent all-time-high of $337.57 on July 23 comes amid historically low implied volatility (IV) -- a combination that has been a bull signal in the past.

According to data from Schaeffer's Senior Quantitative Analyst Rocky White, there have been five other times in the past five years when the stock was trading within 2% of its 52-week high, while its Schaeffer's Volatility Index (SVI) sat in the 20th percentile of its annual range or lower -- as is the case with LULU's current SVI of 36%, which sits near the 13th percentile of its 12-month range. The data shows that one month after these signals, the stock was higher 80% of the time, averaging a one-month return of 3.3%. From its current perch, a move of similar magnitude would put the security just above $339, constituting a new record high.

A look at the equity's options pits shows calls overwhelming puts. In fact, 144,832 calls were were exchanged in the past 50 days, as opposed to only 97,150 puts. On the other hand, LULU's Schaeffer's put/call open interest ratio (SOIR) of 1.13 stands higher than 65% of readings from the past year, implying short-term options traders have been more put-biased than usual.