The equity made Schaeffer's Senior Quantitative Analyst Rocky White's list of 20 stocks with the highest weekly options volume

Thanks to data courtesy of Schaeffer's Senior Quantitative Analyst Rocky White, we have a list below comprised of 20 stocks that have attracted the highest weekly options volume over the last 10 trading days. New additions are highlighted in

yellow, and unsurprisingly tech stocks make up a majority of the list. One tech stock that just landed in the lineup is Twitter Inc (NYSE:TWTR). In this article, we will take a look at the social media stock's recent behavior on the charts, and how the options pits are responding.

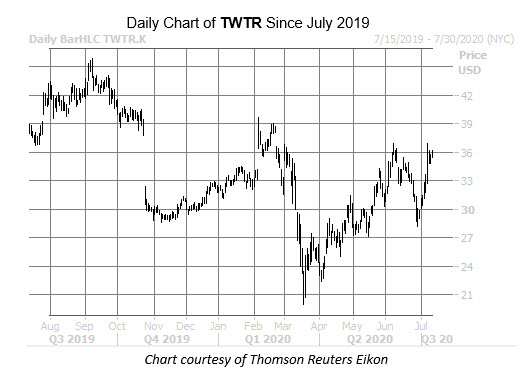

Twitter stock hasn't been able to capitalize on the tech sector's surge as well as some of its outperforming peers. In fact, the security is still trading far below its devastating October 2019 bear gap, with two recent rally attempts rejected by the $36 level. As of today, the equity is trading just below that mark, down 0.6% at $35.18.

It's not all bad news for TWTR, however. The stock boasts a three-month gain of roughly 30%, and could be primed for a round of bull notes from analysts, should the security successfully topple the aforementioned overhead pressure. Of the 24 analysts in coverage, only three say "strong buy," while the rest say "hold." Plus, the consensus 12-month price target of $30.75 is a 12.9% discount to current levels.

Options traders, meanwhile, have been more optimistic. White's data shows that over the past 10 days, 368,363 calls and 161,081 puts have crossed the tape. Today's trading looks like more of the same, with 53,000 calls and 12,000 puts exchanged so far. The July 36 call, which expires this Friday, July 17, is by far the most popular, followed by the 40 call in the same monthly series.