Options volume is triple the average intraday pace

The shares of eBay Inc (NASDAQ:EBAY) are trading up 1.9% at $35.80, after the company said it is selling StubHub to ticket reseller Viagogo for $4.05 billion in cash. The pop has sparked a rush of activity in EBAY's options pits, with volume running at three times the average intraday pace -- and a number of speculators targeting even more upside through week's end.

Specifically, the weekly 11/29 35.50-strike and 36-strike calls are most active, and it looks like new positions are being purchased here. If this is the case, call buyers expect EBAY to be above the respective strikes when the stock market closes early at 1 p.m. ET this Friday, Nov. 29.

Today's bullish bias just echoes the withstanding trend seen in EBAY's options pits. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day call/put volume ratio of 2.19 ranks in the 71st annual percentile, meaning calls have been bought to open over puts at a quicker-than-usual clip.

It's certainly an attractive time to be buying options premium on eBay, based on its Schaeffer's Volatility Index (SVI) of 20%, which ranks in the 5th percentile of its annual range. In other words, short-term EBAY options have priced in lower volatility expectations just 5% of the time over the last year.

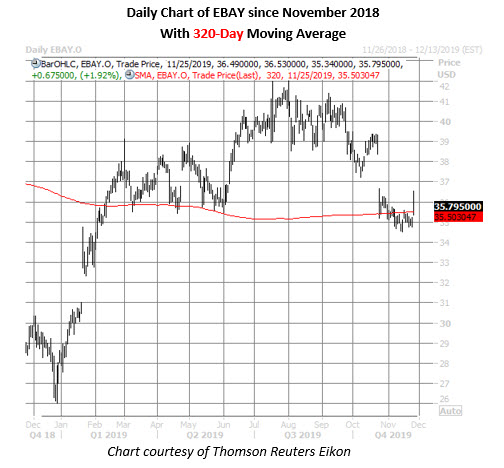

Looking at the charts, EBAY had a strong start to the year, rallying to an annual high of $42 in July, after entering 2019 trading near $28. The retail stock has been trending lower since that technical milestone, though, with a late-October earnings-induced bear gap on exacerbating the negative price action. However, today's pop puts the security back above its 320-day moving average, which has served as both support and resistance since February.