The Supreme Court ruled that states can collect taxes on online sales

The shares of eBay Inc (NASDAQ:EBAY) are in the red this afternoon, after the Supreme Court of the United States (SCOTUS) ruled that states can collect sales taxes from online retailers without a "physical presence" in the state. As EBAY stock drops with other e-commerce concerns, options traders are betting on even more downside for the shares in the short term.

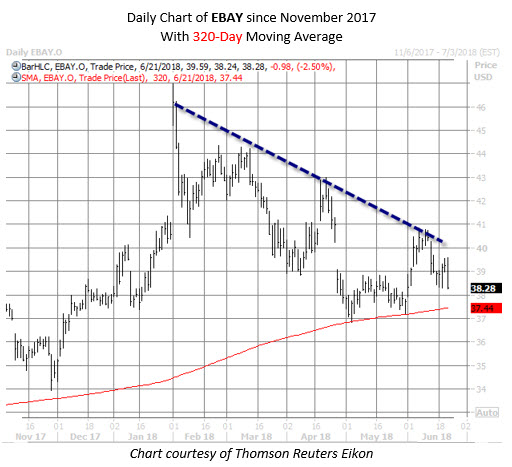

eBay stock was last seen 2.5% lower to trade at $38.28. From a longer-term perspective, the equity has been in a channel of lower highs since peaking at $46.99 in early February, but found support at its 320-day moving average after an earnings-induced bear gap in late April. Since then, EBAY has struggled to fill that gap, recently backing down from the round-number $40 region.

In light of the SCOTUS ruling, EBAY put options are flying off the shelves at three times the normal intraday pace. Roughly 15,000 puts have changed hands so far, compared to 9,500 calls. Digging deeper, it looks like near-term bears may be buying to open the weekly 6/22 39-strike put and the weekly 7/6 38-strike put. If so, the speculators expect eBay shares to extend their trek lower before the options' respective expiration days of tomorrow and Friday, July 6.

Even before today, though, EBAY put buying was more popular than usual. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day put/call volume ratio of 0.86 is in the 66th percentile of its annual range. While this ratio indicates that bought calls still outnumbered puts on an absolute basis, the elevated percentile tells us that traders have initiated bearish bets over bullish at a faster-than-usual clip during the past two weeks.