Call options have been very popular among AKS traders

The 20 stocks listed in the table below have attracted the highest total options volume during the past 10 trading days. Stocks highlighted are new to the list since the last time the study was run, and data is courtesy of Schaeffer's Senior Quantitative Analyst Rocky White. One name of notable interest is steel stock

AK Steel Holding Corporation (NYSE:AKS), which is in focus following the company's $360 million all-cash

purchase of Precision Partners. Here's a quick look at how options traders have been placing bets on shares of AKS.

AK Steel Sees Heavy Call Volume

Options traders have strongly preferred calls over puts on AKS stock. During the past two weeks, 411,243 calls were traded, compared to just 55,395 puts, and call open interest now stands at 524,778 -- good enough to rank in the 84th annual percentile. Zeroing in on just buy-to-open activity, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows more than five long calls were opened for every long put over the past 10 days.

The biggest change in open interest within the past 10 days occurred at the July 8 call, where 81,336 contracts were added. Data provided by the major options exchanges shows a significant amount of both buy-to-open and sell-to-open activity at this strike. Call buyers are betting on AK Steel stock taking out the $8 by the close on Friday, July 21, when the contacts expire. But those selling to open the option are betting on the $8 level acting as a short-term ceiling.

It appears to be a more opportune time to buy premium on AKS options, versus sell it. That is, the stock sports a Schaeffer's

Volatility Scorecard (SVS) reading of 75, meaning the options market has consistently underpriced the steel stock's ability to make large moves on the charts during the past year.

AKS Stock Test Key Technical Levels

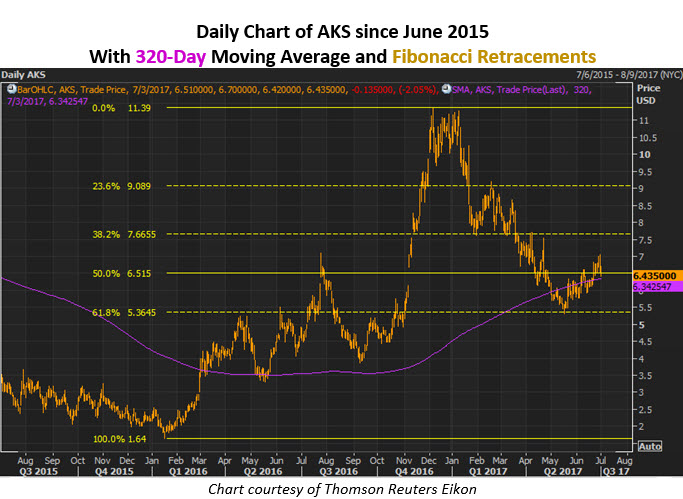

It's an interesting time to check in on AKS stock, too. For example, the shares have been grinding out a series of higher lows since bottom near $5.30 back on May 18. This level represents a 61.8% Fibonacci retracement of its late-2016 surge. Now, AK Steel is testing its footing at a 50% retracement for the same period, an area also home to its 320-day moving average.

Year-to-date, AKS stock has lost 37.5%, including a 2.9% drop today to trade at $6.38. Despite these longer-term technical troubles, a number of analysts in recent weeks have grown more

bullish on the steel sector. AK Steel will host a conference call on its Precision Partners buyout this Wednesday at 10 a.m. ET.