We think MAT shares are ready for a sharp move lower, so it may be time to purchase put options

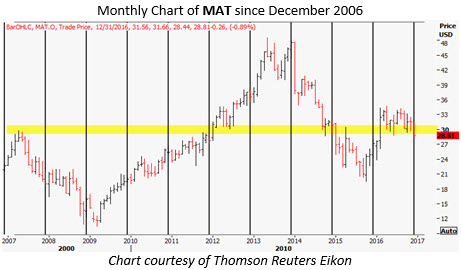

Toymaker Mattel, Inc. (NASDAQ:MAT) finds itself in a precarious position. Not only has the stock underperformed the broader S&P 500 Index (SPX) in 2016, it's also sitting below several key technical levels. For example, the shares are perched just south of their 2007 peak, the $31 level (or three times their 2009 low), and $29.18 (or 50% above their 2015 low). In other words, MAT finds itself looking up at potentially triple-barreled technical resistance.

If the shares fail to break out, they could be pressured lower as optimism begins to wane. This glass-half-full approach is clear among options traders, who have shown a pronounced preference for bullish bets over bearish. MAT's 10-day call/put volume ratio is a top-heavy 8.12 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) -- just 6 percentage points from an annual peak. Plus, the stock's Schaeffer's put/call open interest ratio (SOIR) of 0.46 rests below 87% of comparable readings from the past year. Related to this, peak call open interest resides at the overhead January 2017 30 strike, which could reinforce round-number resistance.

Outside the options arena, analysts are largely bullish toward the shares. MAT has received eight "strong buy" ratings, compared to five "holds" and not a single "sell." In other words, the stock could be vulnerable to downgrades.

Lastly, MAT's short-term options are attractively priced from a volatility perspective, per its Schaeffer's Volatility Index (SVI) of 25% -- in the low 16th annual percentile. Not to mention, our recommended put option has a leverage ratio of negative 4.8, meaning it will double in value on a 17.2% decline in the underlying stock.

Subscribers to Schaeffer's Weekend Series service received this MAT commentary on Sunday night, along with a detailed options trade recommendation -- including complete entry and exit parameters. Learn more about why Weekend Series is one of our most popular trading services.