Option volume is on target for an annual high as Pinnacle Foods Inc (PF) plunges

Pinnacle Foods Inc (NYSE:PF) is 10.6% lower at $41.19, after CEO Robert J. Gamgort announced he will leave at the end of the April to take over as chief executive of now-private coffee specialist Keurig Green Mountain Inc. Prior to today's bear gap, PF was flirting with six-month highs, following a six-week rally of roughly 17%. As the shares suffer their worst day in months -- landing squarely on the short-sale restricted list -- bearish betting in the options pits is catching fire.

Option volume on PF usually runs relatively low, on an absolute basis, but today contracts are changing hands at 26 times their typical intraday rate, with puts outnumbering calls about 3-to-1. In fact, both put volume and total option volume are on pace to hit new annual highs.

In light of the surging volatility expectations, PF's 30-day at-the-money implied volatility jumped to 31.2% today -- higher than 88% of comparable readings from the past 12 months. And today's appetite for puts is much stronger than usual -- the resulting intraday put/call volume ratio of 2.74 ranks higher than 85% of the past year's readings.

Digging deeper, the most popular strike today is the April 45 put, where it appears traders may be buying to open new positions. Speculators purchasing this put are hoping PF will extend its journey south of $45 through the option's expiration on Friday, April 15. Put open interest, meanwhile, already sits in the 99th percentile of its yearly range, and could hit an annual high if today's April 45 puts are being initiated.

Analysts have been split in their opinions, with four rating the stock a "hold," compared to four "buys" or better. And pessimism seemed to be waning prior to today, as short interest on PF fell by 16% during the last two reporting periods, to account for just 2.5% of the security's available float.

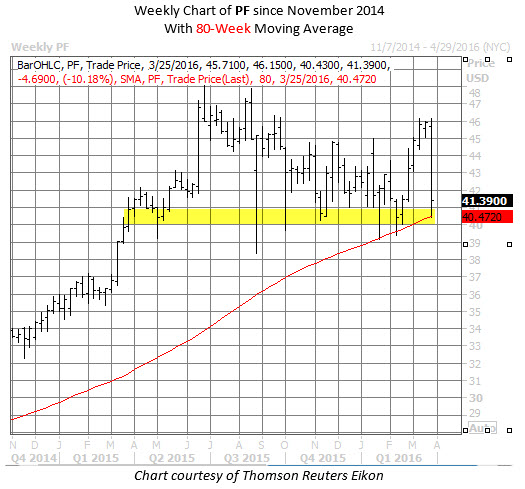

On the technical front, PF seems to have found a familiar floor in the $40-$41 region. This area served as support for Pinnacle Foods Inc (NYSE:PF) over the past year, and is home to the equity's ascending 80-week moving average -- a trendline it has tested (but never breached) multiple times this year.

Sign up now for Schaeffer's Market Recap to get all the day's big stock movers, must-know technical levels, and top economic stories straight to your inbox.