Pre-earnings traders circled URBN and CSIQ, while TWTR was the target of a massive spread

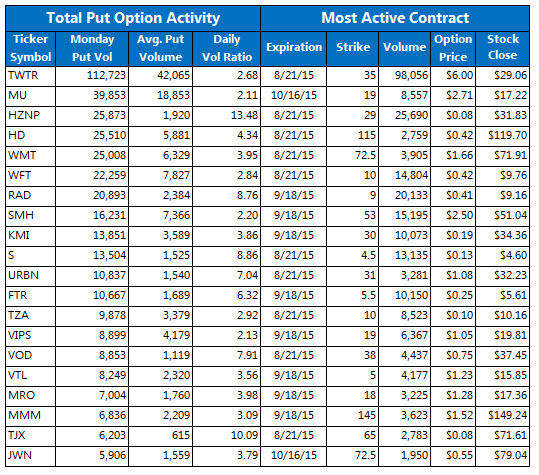

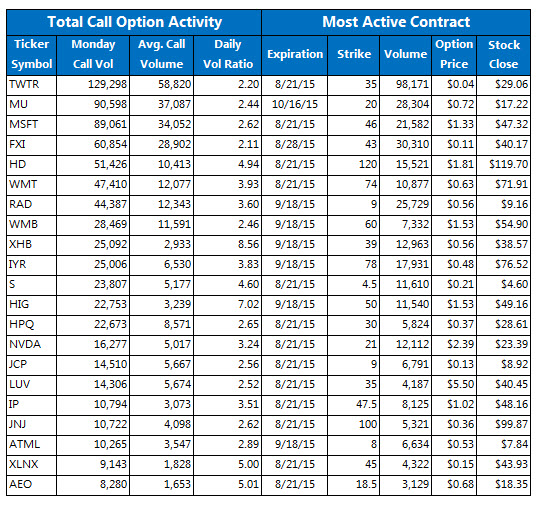

The Dow finished higher again today, battling back from a triple-digit deficit, thanks to encouraging housing data. Across all 12 options exchanges, 6.73 million calls crossed, compared to 6.24 million puts. The day's put/call volume ratio closed at 0.92.

Twitter Inc (NYSE:TWTR) was the target of a massive spread at the August 35 strike, with nearly 100,000 contracts traded on both the call and put sides. Meanwhile, pre-earnings traders circled Urban Outfitters, Inc. (NASDAQ:URBN) and Canadian Solar Inc. (NASDAQ:CSIQ).

Sprint Corp (NYSE:S) options changed hands at five times what's normally seen, as traders placed bets in the wake of iPhone news. Mobileye NV (NYSE:MBLY) call volume spiked to three times the norm, as the stock touched new highs on upbeat analyst attention.