Options bulls have been chiming in on META and BBAI

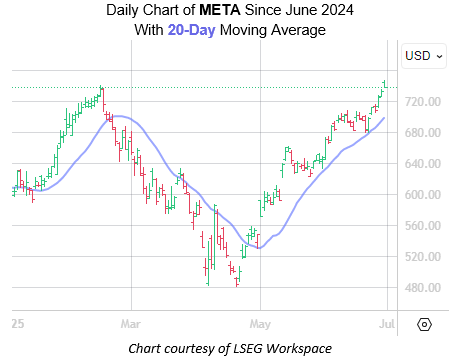

Meta Platforms Inc (NASDAQ:META) stock hit a record high of $747.90 today, after news that the tech giant ramped up its artificial intelligence (AI) efforts. The company reportedly hired four more researchers from OpenAI for its 'superintelligence' team, and the shares are continuing their rally from mid-April lows in response. With recent support at the 20-day moving average, META is on track for its fifth win in six sessions. Year-to-date, the equity is up 26%.

The recent price action has attracted the attention of options bulls. META's 50-day call/put volume ratio of 2.16 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks higher than all other readings from the past year. These options are reasonably priced at the moment, too, per the stock's Schaeffer's Volatility Index (SVI) of 25%, which ranks in the very low 4th percentile of its annual range.

Meanwhile, BigBear.ai Holdings Inc (NYSE:BBAI) was last seen up 20.5% at $7.04, after news that the company is partnering with Easy Lease and Vigilix Technology Investment in the United Arab Emirates (UAE) to accelerate AI adoption across several industries. Trading at its highest levels since February, BBAI is up 58.9% since the start of the year.

BBAI's options pits are typically highly skewed toward calls. The security has seen 8.88 calls exchanged for every put in the last 10 weeks at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). Today, 257,000 calls have crossed the tape in comparison to 71,000 puts, with overall volume already at 3.1 times the daily average. The weekly 7/3 7-strike call is the most popular, with new positions being opened there.