Chevron stock is up more than 50% this year

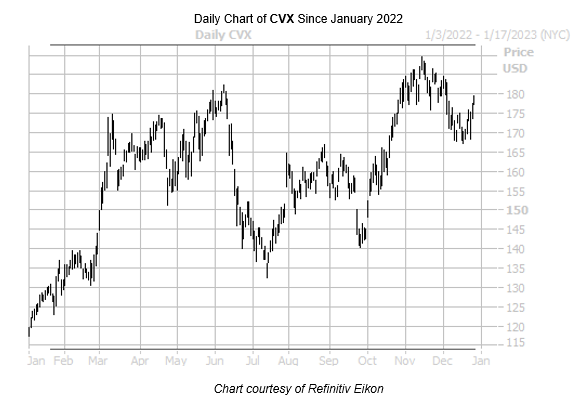

Chevron Corporation (NYSE:CVX) is the best performing Dow component of 2022, after adding more than 50% year-to-date. Though CVX has pulled back from its Nov. 14, all-time high of $189.68, the equity last week turned in its best weekly performance since early October. What's more, the shares were last seen 1% higher to trade at $179.15, and earlier hit a three-week high of $179.48 as energy firms add to gains amid rising oil prices.

All in all, 10 blue-chip members gave investors back a positive return. Chevron stock, however, was the clear outperformer, with second place Merck (MRK) sporting a roughly 46% lead this year. In a distant third, Travelers (TRV) is up 21.1%, while Honeywell International (HON) rounds out the list of winners with a 2.6% lead.

Puts are preferred in the options pits, which means options traders have likely been trying to locate Chevron stock's ceiling. The shares sport a 50-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) that sits in the highest percentile of its annual range.

Echoing this, CVX's Schaeffer's put/call open interest ratio (SOIR) of 1.19 ranks in the 96th percentile of annual readings, meaning short-term options traders are also enamored with bearish bets..

Those looking to join these traders should do so now, as the stock's near-term options are attractively priced. The equity's Schaeffer's Volatility Index (SVI) stands at 27% stands in the 22nd percentile of its annual range. This indicates that now is an attractive time to jump aboard the energy name with options.