The airline will cut 50 domestic flights per day out of the Newark Liberty International Airport

United Airlines Holdings Inc (NASDAQ:UAL) just announced it's cutting 50 domestic flights per day, or roughly 12% of its flights, out of the Newark Liberty International Airport in an effort to reduce delays caused by airport construction and capacity issues. The cuts will begin on July 1. This move comes one week after Transportation Secretary Pete Buttigieg reached out to CEOs of top airlines to ensure the same disruptions seen recently don't continue over the remainder of the summer.

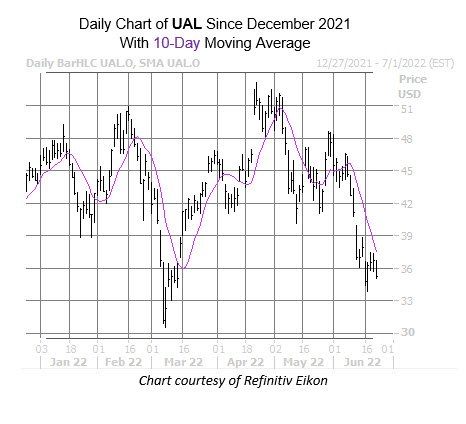

In response, UAL was last seen down 4.2% to trade at $35.19. It's been a rocky year for the airline stock, which tumbled to a three-month low of $33.86 last week, with pressure emerging at the 10-day moving average. The stock is now off 19.3% in 2022, and 35.9% in the past 12 months. It's worth noting that UAL has a 14-day Relative Strength Index (RSI) of 27, which places it in "oversold" territory. This could be indicative of a short-term bounce on the charts.

Short-term options bears have targeted UAL of late. In fact, these traders haven't been more put-biased over the past year, per the security's Schaeffer's put/call open interest ratio (SOIR) of 1.39, which stands in the highest percentile of its annual range.

Short interest has also been on the rise, up 15.3% in the last two reporting periods. The 23.04 million shares sold short make up 7.1% of the stock's available float, or a little under two days' worth of pent-up buying power.

Analysts, on the other hand, are split on the security. Of the 14 in coverage, seven say "buy" or better, and seven say "hold" or worse. Meanwhile, the 12-month consensus price target of $59.62 is a 69.6% premium to current levels.