A historically bullish signal just flashed on the charts

This commentary first appeared on Forbes Great Speculations, where Schaeffer's Investment Research is a regular contributor.

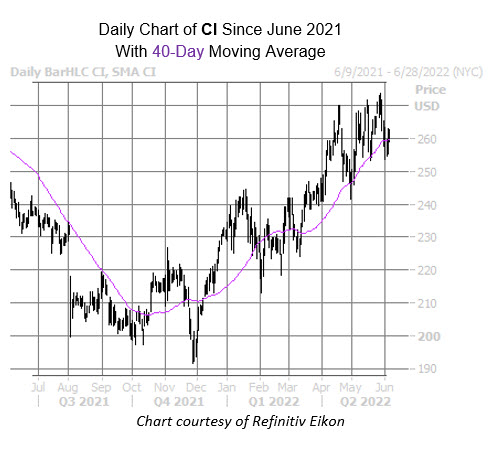

Compared to much of the market, healthcare stock Cigna (CI) has held up fairly well. The equity boasts a 15.2% year-to-date lead, and has even managed to cling to a positive year-over-year return. While the security has taken a breather since touching a fresh annual high of $273.57 during last Tuesday’s session, there’s reason to believe a trendline sitting just below could put additional wind in CI’s sails this June.

Cigna stock just pulled back within one standard deviation of its 40-day moving average after a lengthy period above the trendline. According to a study from Schaeffer’s Senior Quantitative Analyst Rocky White, CI has seen six similar occurrences over the past three years. One month after 83% of these occurrences, the shares were higher, averaging a 3.7% return during this time period. From its current perch, a similar move could put CI just below the $271 mark and closer to Tuesday’s peak.

Plus, there’s still room for upgrades for Cigna stock. Of the 16 in coverage, five still say “hold.” Meanwhile, the 12-month consensus price target of $291.17 is a 10.3% premium to current levels.

An unwinding of bearishness among short-term options traders could also provide tailwinds. Cigna stock’s Schaeffer’s put/call open interest ratio (SOIR) of 1.12 sits higher than 77% of readings from the past year, indicating these traders are incredibly put-biased right now.