NU Skin will report first-quarter earnings after the close today

The shares of NU Skin Enterprises Inc (NYSE:NUS) are up 4% to trade at $54.16 at last check. Today's price action comes just ahead of the company's first-quarter earnings, due out after the close, in which analysts expect the beauty product creator to post earnings of 72 cents per share.

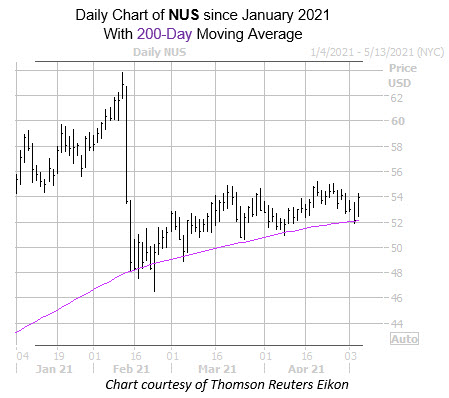

On the charts, NUS has been seeing pressure at the $55 region. However, the 200-day moving average has moved in as support over the past couple months. A sharp post-earnings bear gap in February knocked Nu Skin stock down a peg from a Feb. 10 annual high of $63.85. Since then, the equity has been contending with its year-to-date breakeven level.

A look back at the company's earnings history reveals that half of the past eight sessions had a positive post-earnings response, including a 27.9% gain last May. The security averaged a next-day return of 12.7% in the last eight sessions, regardless of direction. This time around, the options market is pricing in a slightly smaller move of 12.1%.

Ahead of the event, options traders are chiming in with 12.2 times the usual daily volume today, albeit with relatively low absolute volume. So far, 715 calls and 1,214 puts have crossed the tape, with the May 50 put and May 65 call tied for the most activity, and new positions being opened at both.

This penchant for puts is a bit of a turnaround from the last 10 weeks, per NUS' 50-day call/put volume ratio of 1.15 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio stands higher than 90% of readings from the past year, indicating a much stronger-than-usual preference for calls during this time.