The company already opened two Los Angeles movie theaters today

The shares of AMC Entertainment Holdings Inc (NYSE:AMC) are soaring, up 26.8% at $14.12 at last check, after the company said it plans to reopen California locations this week, starting with two movie theaters in Los Angeles today. Local authorities cleared the proceedings while limiting attendance to 25% capacity, and more locations will open in the city and across the state on March 19.

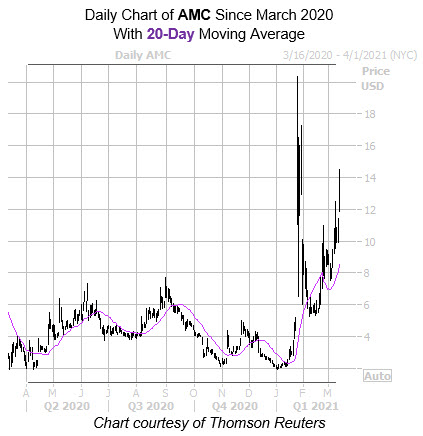

On the charts, the security is on its way up again, after cooling down from a massive bull gap to a Jan. 27, three-year high of $20.36. The shares reclaimed support at the 20-day moving average in February, and are now eyeing their best day since January, and third consecutive gain. Longer term, AMC sports a jaw-dropping 346.9% year-over-year lead.

Analysts are bearish towards the security, leaving plenty of room for price-target hikes and/or upgrades moving forward. Of the nine in question, six carry a tepid "hold" rating, while three say "strong sell." Plus, the 12-month consensus target price of $3.44 is a 75.9% discount to current levels.

And while sellers are running for the exits, there is still plenty of pessimism left to be unwound, which could push shares even higher. Short interest fell 47.1% over the last two reporting periods, yet the 55.49 million shares sold short still make up a whopping 106.6% of the stock's available float.

The options pits are more optimistic, with calls popular. This is per the security's 50-day call/put volume ratio of 2.49 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits in the 79th percentile of its annual range. This means calls are being picked up at a relatively faster-than-usual rate.

Drilling down to today's options activity, 704,000 calls have crossed the tape so far, which is double the intraday average, and more than triple the number of puts traded. Most popular is the March 15 call, followed by the 14 call in the same monthly series, with positions being opened at both. Buyers of these options expect more upside for AMC by the end of the week, when contracts expire.

These buyers are in luck, too, as AMC options are affordably priced at the moment. The security's Schaeffer's Volatility Index (SVI) of 192% sits higher than only 21% of all other readings from the past year. This means options players are pricing in lower-than-usual volatility expectations right now.