FRTA stock options traders are targeting even bigger gains

Forterra Inc (NASDAQ:FRTA) stock is up 19.1% at $6.93 -- set for its best day since November 2017 -- after Goldman Sachs double-upgraded the drainage pipe manufacturer to "buy" from "sell," and boosted its price target to $8 from $4.25. The analyst in coverage said accelerating pricing could be a positive driver in coming quarters, and called FRTA stock a "high risk/high reward option for investors."

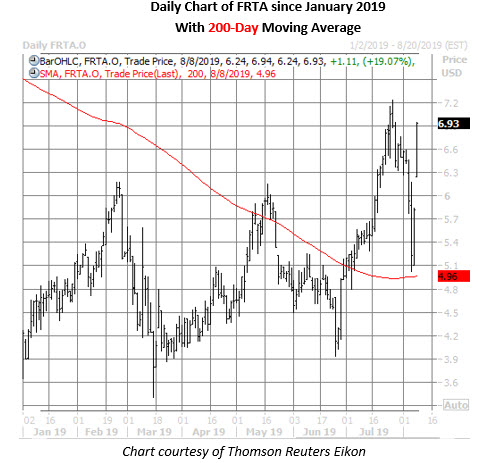

Goldman's new rating marks the only "buy" recommendation on FRTA, with the other three covering analysts calling the stock a tepid "hold." The average 12-month price target, meanwhile, sits at a roughly 10% discount to current levels at $6.25. With the shares now up 85% year-to-date and holding above their 200-day moving average, more analyst adjustments could come down the pike.

Elsewhere on Wall Street, FRTA shorts are likely feeling the heat. There are currently 4.31 million Forterra shares controlled by these bearish bettors, representing 23.3% of the stock's available float, or 27.2 times the average daily pace of trading. A capitulation from some of the weaker bearish hands could keep the wind at the equity's back.

Today's options traders are positioning for more upside. With just over two more hours left in today's session, 176 FRTA options are on the tape. While light on an absolute basis, this is four times what's typically seen at this point. Speculators may be purchasing new positions at the August 7.50 call, meaning they expect the stock to break out above $7.50 by expiration at the close next Friday, Aug. 16.