Oppenheimer issued lofty price targets for the pair of healthcare stocks

Penny stocks TherapeuticsMD Inc (NASDAQ:TXMD) and Strongbridge Biopharma (NASDAQ:SBBP) are higher today, after analysts set some lofty goals for the healthcare names. In the wake of a Food and Drug Administration (FDA) nod, Oppenheimer hiked its price target on TXMD stock to $14 from $12 -- more than double the shares' current price. Likewise, Oppenheimer this morning lifted its price target on SBBP to $15 from $12, representing expected upside of 150% from the security's close of $6 on Monday.

TXMD Remains Popular Among Shorts

TherapeuticsMD made noise this week, after the FDA approved Annovera, a birth control device made by the Population Council. On July 31, TXMD entered into an exclusive licensing agreement to commercialize the 12-month contraceptive ring. Under terms of the agreement, TherapeuticsMD will pay the Population Council a milestone payment of $20 million after the FDA approval, and will pay another $20 million upon release of the first commercial batch of Annovera. The company said yesterday it expects the product to be commercially available as early as the third quarter of 2019.

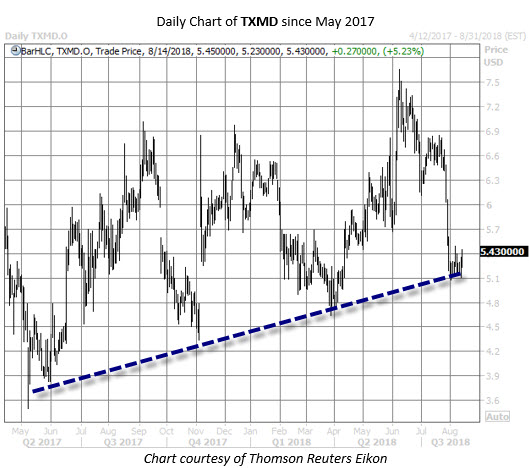

Despite the news, TXMD stayed within its recent range in the $5.50 neighborhood, which the shares slid into after an earnings miss on July 30. However, the equity may have found a floor atop a trendline connecting higher lows since May 2017, and its 14-day Relative Strength Index (RSI) fell to 29 yesterday -- in oversold territory. At last check, TXMD was up 5.2% to trade at $5.43.

While most analysts are upbeat toward TherapeuticsMD -- all six following the stock consider it a "strong buy" -- there are plenty of people rooting against the shares. Short interest represents one-third of the equity's total available float, or more than 29 days of pent-up buying demand, at TXMD's average pace of trading. Should the stock, in fact, rally as Oppenheimer predicts, quite a few shorts could get squeezed.

SBBP Just Off Best Week in a Year

Strongbridge Biopharma stock broke out of a downtrend last week, after the company reported earnings and said it plans to discuss the potential for accelerated approval of Recorlev with the FDA, following a successful late-stage study treating Cushing's syndrome. In fact, SBBP shares shot 31.2% higher last week, marking their best week since June 2017. The security has added another 4.1% already this week, and was last seen up 5.8% on the day, trading at $6.35. The shares are closing in on their 200-day moving average, which acted as a foothold for SBBP until June.

Traders looking to speculate on Strongbridge stock's short-term trajectory can pick up options at a relative bargain. The thinly traded stock sports a Schaeffer's Volatility Index (SVI) of 145% -- in the bottom 5% of its annual range. This indicates that relatively low volatility expectations are being priced into near-term SBBP options.