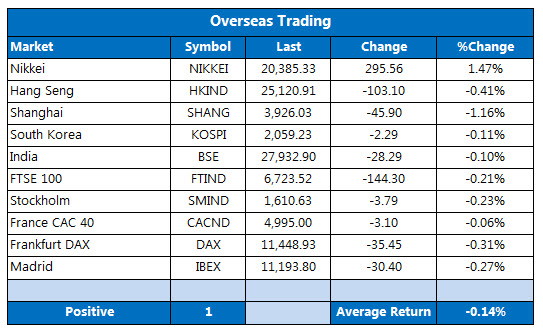

Most international benchmarks are trading lower today, following recent Greece-related gains

It was a mostly lower finish in Asia today. In China,

another volatile session for the Shanghai Composite eventually resolved to the downside, with the index shedding 1.2% following a three-day rally. Pressuring the benchmark was a sell-off in financial names, despite data showing a pop in new bank loans last month. Elsewhere, Hong Kong's Hang Seng fell 0.4%, while South Korea's Kospi gave back 0.1%. Japan's Nikkei managed to outperform its regional peers, tacking on 1.5% amid a cooling yen. Meanwhile, the Bank of Japan kicked off its two-day policy meeting today, with an update due tomorrow.

European markets are also below breakeven at midday, taking a breather from yesterday's big Greece-related surge. Traders are now taking a cautious stance toward

the country's bailout deal, which still has to be approved by eurozone parliaments. Additionally, a late-night nuclear arms agreement between Iran and several international heavyweights has sent energy names lower. At last check, the German DAX is off 0.3%, London's FTSE 100 is down 0.2%, and the French CAC 40 is flirting with a 0.1% loss.