Trump's "big, beautiful bill" is waiting for its final vote in the House

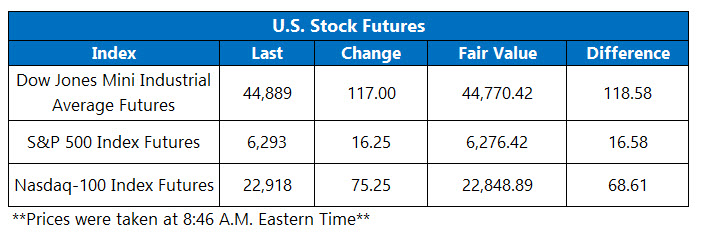

Futures on the S&P 500 Index (SPX), Nasdaq-100 Index (NDX), and Dow Jones Industrial Average (DJIA) are on the rise amid upbeat jobs data, with all three benchmarks headed for weekly wins. June's nonfarm payrolls rose by 147,000, above expectations of 110,000, while the unemployment rate fell to 4.1%, narrower than the 4.3% estimate.

Eyes remain on President Trump's "big, beautiful bill," which has now moved to the House of Representatives for a final vote. Please note the stock market will close at 1 p.m. ET today and be closed tomorrow in observance of the Independence Day holiday.

Continue reading for more on today's market, including:

- Fed meeting minutes are on deck next week.

- Breaking down strategies to support women investors.

- Plus, investor stake boosts TRIP; EV name breaking records; and software stock lands spot on S&P 500.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw 2.1 million call contracts and 1.1 million put contracts traded on Wednesday. The single-session equity put/call ratio rose to 0.55, while the 21-day moving average stayed at 59.

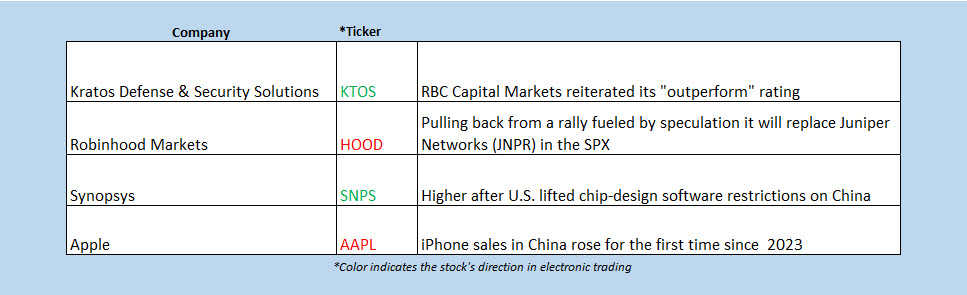

- Trip planning platform Tripadvisor Inc (NASDAQ:TRIP) is 8.7% higher in electronic trading, after news broke that Starboard Value will take a more than 9% stake in the company. TRIP has been fighting to remain above its year-to-date breakeven mark, sitting at the +1% line after yesterday's close. Should these pre-market gains hold, the equity will be on track for a third-straight win.

- Electric vehicle (EV) name Lucid Group Inc (NASDAQ:LCID) is up 0.5% before the bell, after the company reported a record 3,309 EV deliveries for the second quarter. Today's pop will give a much-needed boost to the equity, which has been flirting with a baseline of $2.00, a chip-shot from its record low of $1.93. LCID slipped into penny stock territory last year and now sport a 2025 deficit of 32%.

- Datadog Inc (NASDAQ:DDOG) is up 9.1% ahead of the open, after news that it will replace Juniper Networks (JNPR) on the S&P 500 on July 9. This comes days after the the latter was bought out by Hewlett Packard Enterprise (HPE). Wedbush also hiked its price target on DDOG to $170 from $140. DDOG has been recovering from a pullback to $81 in April, but remains 5% lower year to date.

- A quick look at the economic calendar for this past week.

Vietnamese Stocks Hit 3-Year Highs

Asian markets closed mostly higher on Thursday. The South Korean Kospi led gains with a 1.3% pop, while China’s Shanghai Composite and Japan’s Nikkei rose 0.2% and 0.06%, respectively. Elsewhere, the benchmark Vietnam Index rose 0.3% to its highest level in three years after the U.S.-Vietnam trade deal. Hong Kong’s Hang Seng missed out on gains, losing 0.6%.

European markets are trading quietly today. London’s FTSE 100 is up 0.5% at last glance, after U.K. bond yields surged amid rumors of Finance Minister Rachel Reeves’ departure, though Prime Minister Keir Starmer has since said that she is “going nowhere.” Meanwhile, the French CAC 40 is down 0.05%, while the German DAX is 0.09% higher.