Bank stocks are on the rise after sharing plans to hike dividends

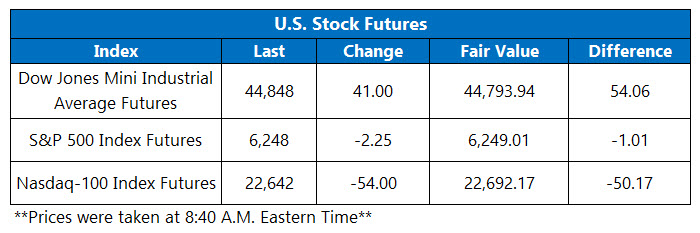

Futures on the S&P 500 Index (SPX), Nasdaq-100 Index (NDX), and Dow Jones Industrial Average (DJIA) are struggling for direction this morning. The ADP employment report showed private payrolls fell 33,000 in June, staggeringly lower than the 100,000 estimated increase and the first monthly decline since March 2023.

Meanwhile, bank stocks are moving higher after the majority of institutions shared plans to hike dividends after the Federal Reserve's stress test. Eyes are also on President Donald Trump's "Big, Beautiful Bill," as it moves to the House following a slim victory in the Senate.

Continue reading for more on today's market, including:

- Schaeffer's Senior Quantitative Analyst Rocky White shares 50 stocks to target for the rest of 2025.

- Snowflake stock pullback could be short-lived.

- Plus, Apple shares drive higher on bull note; insurance name plunging; and M&A rumors boost IT services stock.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 2 million call contracts and over 1 million put contracts traded on Tuesday. The single-session equity put/call ratio remained at 0.51, while the 21-day moving average stayed at 59.

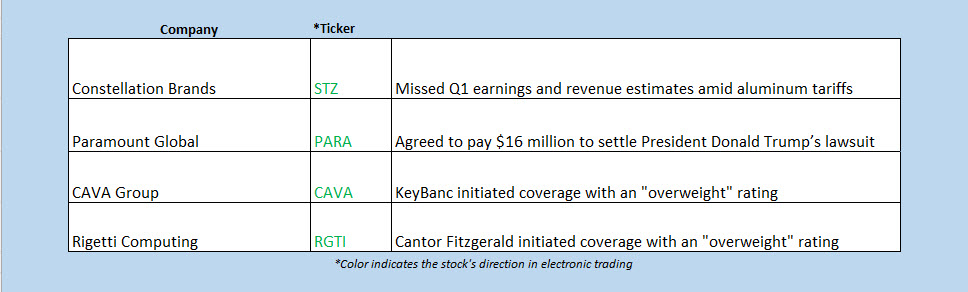

- Tim Cook's Apple Inc (NASDAQ:AAPL) is 1.4% higher in electronic trading, enjoying an upgrade from Jefferies to "hold" from "underperform." The brokerage also hiked its price target to $188.32 from $170.62, citing near-term stability for AAPL. So far for 2025, Apple stock has shed 17%.

- Health insurance name Centene Corp (NYSE:CNC) is plunging 30.5% before the bell, after the company withdrew its fiscal-year earnings outlook. The pullback will push the shares even further into the red for the year, and put the equity on track to snap its four-day win streak.

- Verint Systems Inc (NASDAQ:VRNT) is charging 10.2% higher ahead of the open, receiving a boost from news that private-equity name Thomas Bravo is looking to acquire the IT services giant. Over the past 12 months, VRNT has shed 43%, with Tuesday's breakout above $22 short-lived.

- The beginning of July features the ADP employment report and manufacturing data.

Inflation Data, Bank Stocks In Focus Overseas

Asian markets finished mostly lower on Wednesday, though Hong Kong’s Hang Seng managed to tack on 0.6%, and Singapore equities hit record highs. The South Korean Kospi fell 0.5%, after the country’s year-over-year inflation rate came in at a higher-than-expected 2.2% in June, growing at its fastest pace since January. Japan’s Nikkei dropped 0.6%, while China’s Shanghai Composite settled slightly below breakeven with a 0.09% loss.

European bourses are on the rise, with mining and banking stocks leading the charge as investors keep an eye on the European Central Bank (ECB) forum. In other news, U.K. bond yields spiked after Prime Minister Keir Starmer did not show full support of Finance Minister Rachel Reeves amid welfare reforms. The French CAC 40 was last seen up 1.3%, while London’s FTSE 100 and the German DAX are 0.1% and 0.4% higher, respectively.