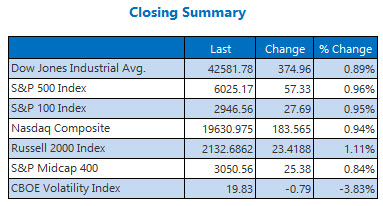

All three major indexes finished higher

The Dow rose 374 points to kick off the week after reports that a retaliatory attack by Iran on a U.S. base in Qatar was intercepted, leaving no casualties. The Nasdaq and S&P 500 finished firmly in the black as well, the former by triple-digits. Meanwhile, the S&P global flash U.S. manufacturing purchasing managers' index (PMI) held at 52 in June, above forecasts, while the S&P flash U.S. services PMI came in at 53.1, also above estimates. Existing home sales increased 0.8% in May.

Continue reading for more on today's market, including:

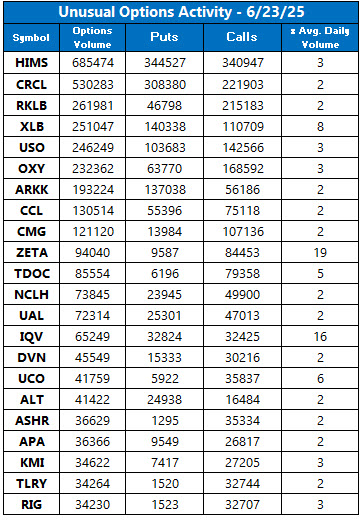

- Cloud computing stock popular among options traders.

- J.P. Morgan chimes in on the gaming sector.

- Plus, the latest with stablecoin; behind DASH's upgrade; and why NVO fell.

5 Things to Know Today

-

- Tesla (TSLA) stock is surging after the launch of its robotaxi service. (MarketWatch)

-

- DoorDash stock upgraded after latest acquisition.

- Two pharma stocks sink lower after breakup.

There were no earnings of note today.

Crude Futures Drop, Brushing Off Middle East Tensions

Oil prices dropped sharply today, brushing off Iran's potential closure of the Strait of Hormuz, after the restrained attack by Iran on a U.S. base. July-dated West Texas Intermediate (WTI) crude fell $5.33, or 7.22%, to close at $68.51 per barrel.

Bullion inched higher following Friday's weekly loss. U.S. gold futures rose 0.4% at $3,400.70 per ounce.