Retail sales and geopolitical tensions are weighing on Wall Street this morning

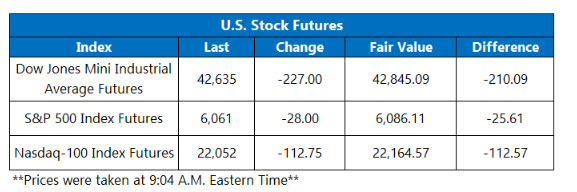

Stock futures are moving lower today, poised to brush off yesterday's rebound. President Donald Trump highlighted geopolitical tensions last night, posting on Truth Social that "everyone should immediately evacuate Tehran." Shortly after that, Trump left the G7 summit in Canada early, with no ceasefire announced between Israel and Iran. In response, oil prices are back on the rise, with July-dated crude last seen 1.7% higher. Elsewhere, retail sales fell 0.9% in May, worse than expectations of a 0.6% dip.

Continue reading for more on today's market, including:

- Senior V.P. of Research Todd Salamone on why the 6,000 level continues to be so important for the SPX.

- Robinhood stock quietly vaulting up the charts.

- Plus; solar stocks find shade; LEN revenue pops; and SoftBank trims TMUS.

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.8 million call contracts and over 933,252 million put contracts traded on Monday. The single-session equity put/call ratio slid to 0.51, while the 21-day moving average stayed at 0.59.

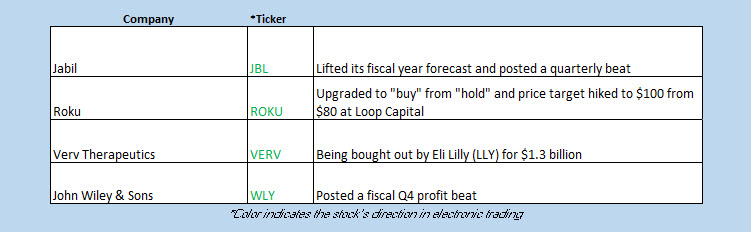

- First Solar Inc (NASDAQ:FSLR) stock is down 24.2% before the bell, with alternative energy names falling across the board as the U.S. Senate deliberates a phase-out of solar and wind tax credits by 2028. First Solar stock is poised to cede its year-to-date breakeven level today, and pad its 36% year-over-year deficit.

- Lennar Corp (NYSE:LEN) stock is 1.2% higher ahead of the open, after the homebuilder's second-quarter revenue topped analyst estimates. LEN is down 17% in 2025, and will be testing a confluence of moving averages today.

- The shares of T-Mobile US Inc (NASDAQ:TMUS) are 4% lower in electronic trading, after Bloomberg reported that Softbank sold 21.5 million shares of stock overnight. T-Mobile stock is 4.6% higher in 2025, and up 31.2% over the last 12 months.

- What to expect for this holiday-shortened week.

Investors Unpack Bank of Japan Decision

Asian markets were mixed on Thursday as investors weighed the conflict between Israel and Iran, with President Donald Trump calling for the evacuation of Tehran and leaving the G7 summit early due to geopolitical tensions. Also in focus was the Bank of Japan’s (BoJ) decision to keep interest rates steady at 0.5% amid potentially growing risks. Japan’s Nikkei added 0.6% and South Korea’s Kospi rose 0.1%. Meanwhile, China’s Shanghai’s Composite was flat, and Hong Kong’s Hang Seng shed 0.3%.

European markets are lower as traders shake off a previously announced trade deal between the U.S. and the U.K., with both countries still working out an agreement over steel and pharmaceutical tariffs. The German DAX is down 0.8%, France’s CAC 40 is 0.6% lower, and London’s FTSE 100 was last seen down 0.3%.