President Trump is urging Iran to make a nuclear deal

Trade deals and tariffs are old news, with geopolitical tensions now in the spotlight. Overnight, Israel launched a series of missile strikes across Iran, efforts announced as attempts to curtail the country's nuclear program. Iran has called the assault a 'declaration of war,' and retaliatory drone strikes have already been launched.

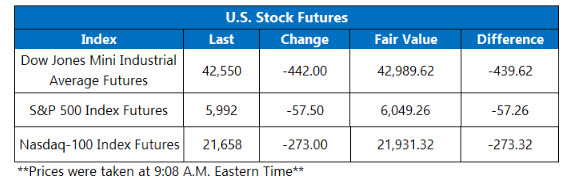

In response, President Donald Trump took to Truth Social, urging Iran to negotiate a nuclear deal. Dow Jones Industrial Average (DJIA) futures is down 442 points, while S&P 500 (SPX) and Nasdaq-100 (NDX) futures are also deep in the red. Oil prices are soaring, with West Texas Intermediate (WTI) July-dated crude last seen 8.2% higher.

Continue reading for more on today's market, including:

5 Things You Need to Know Today

- The Cboe Options Exchange (CBOE) saw more than 1.8 million call contracts and over 1 million put contracts traded on Thursday. The single-session equity put/call ratio rose to 0.58, while the 21-day moving average stayed at 0.59.

- Chevron Corp (NYSE:CVX) stock is 2.7% higher before the bell. The blue-chip energy giant is climbing with oil after the Israel strike against Iran, with supply outlooks now threatened. CVX is trading around its year-to-date breakeven level, but is poised to open at its highest level since early April today.

- Newmont Corporation (NYSE:NEM) stock is 1.3% higher ahead of the bell, with safe-haven assets up amid rampant geopolitical uncertainty. The gold mining stock is 50% higher in 2025, and could make a run at its Oct. 22 two-year high of $58.72.

- The shares of L3Harris Technologies Inc (NYSE:LHX) are 1.4% higher in electronic trading, with defense stocks across the board gaining. LHX is set to open at its highest level since November, and is 19% higher year-to-date.

- What to expect for the upcoming holiday-shortened week.

Overseas Markets Feel Pain of Middle East Conflict

Asian markets fell Friday, as the ramped up Israel-Iran conflict prompted fears of retaliation and broader conflict. South Korea’s Kospi dropped 0.9%, snapping a seven-day win streak. Japan’s Nikkei lost 0.9%, as investors sought safety in bonds, pushing 10-year yields to a one-month low. Meanwhile, Hong Kong’s Hang Seng dipped 0.6%, and China’s Shanghai Composite slipped 0.8%

European markets are sharply lower this afternoon, with travel and leisure stocks leading losses amid surging oil prices and suspended flights to Tel Aviv. Germany’s DAX is down 1.1%, France’s CAC 40 has dropped 0.8%, and London’s FTSE 100 is 0.2% lower. Oil and gas stocks are in the green, especially oil tanker Frontline – up 8% on supply concerns – while airline stocks including Wizz Air, Air France-KLM, and IAG are all down more than 4%.