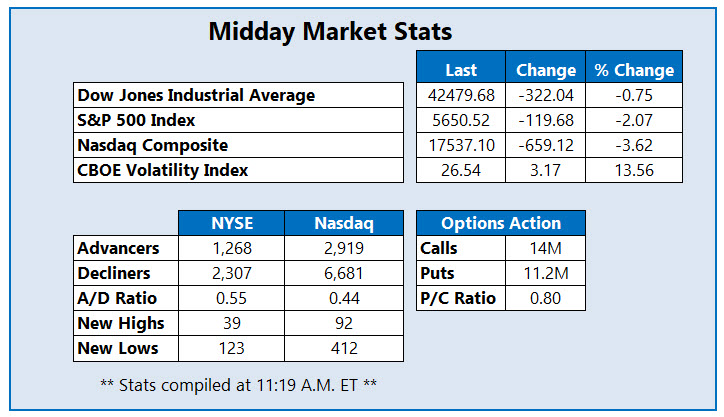

All three major indexes are down triple digits at midday

Stocks are looking to extend last week's losses, as recession fears grip Wall Street. The Dow Jones Industrial Average (DJI), Nasdaq Composite (IXIC), and S&P 500 Index (SPX) were last seen down triple digits as tech stocks pummel. Traders are worried about tariffs, which could result in higher prices and dissuade the Federal Reserve from lowering interest rates. The market is also bracing for inflation data, with the consumer price index (PPI) and producer price index (PPI) for February due out later this week.

Continue reading for more on today's market, including:

- Buyout sends Redfin stock to best day ever.

- 3 bank stocks under pressure right now.

- Plus, bears target BIIB; embattled solar stock on the rise; and Carnival stock sinking.

Options bears are blasting Biogen Inc (NASDAQ:BIIB) today, with 33,000 puts traded so far -- 48 times the intraday average volume -- compared to only 1,748 calls. Most active is the June 125 put, where new positions are being opened. BIIB is 4.1% higher to trade at $156.54 at last glance and eyeing its seventh-straight daily gain, after a U.S. Securities & Exchange Commission (SEC) filing revealed asset management company Amundi hiked its stake in the biotech giant by 35.6% in the fourth quarter. So far in March, BIIB has climbed 10%.

Enphase Energy Inc (NASDAQ:ENPH) is among the SPX's leaders today, 4.7% higher to trade at $64.55 and on track for its fifth-straight daily gain. Today's surge follows news that E Fund Management Co. Ltd. lifted its position by 50.1% in the fourth quarter, per a new SEC filing. ENPH has shed more than 50% in the last nine months and is still struggling with overhead pressure at its 80-day moving average, as it rallies off its March 4, four-year low of $51.63.

Carnival Corp(NYSE:CCL) stock is near the bottom of the SPX today, last seen down 7.8% to trade $19.04 -- its lowest level since October. The shares fell 25.2% over the last three months, and are pacing for their worst single-day percentage loss since January 2024. Gapping below the 200-day moving average, CCL could also mark its fifth drop in the last six sessions, should these losses hold.