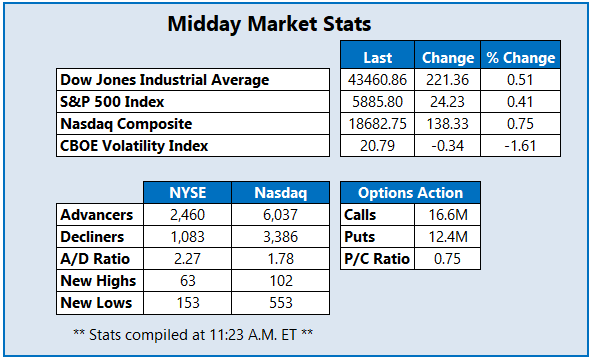

All three major benchmarks have turned higher today

Stocks are higher midday, getting a much-needed lift from this morning's inflation data that came in line with estimates. The Dow Jones Industrial Average (DJI) is up a sharp 221 points following two days of triple-digit losses and eyeing a small weekly gain. The S&P 500 Index (SPX) and Nasdaq Composite Index (IXIC), however, are still headed for their worst weeks since September.

Continue reading for more on today's market, including:

Call traders are blasting retail stock American Eagle Outfitters Inc (NYSE:AEO), with 32,000 calls exchanged so far -- 49 times the amount typically seen at this point -- in comparison to 639 puts. The weekly 3/7 14-strike call accounts for most of this activity, with new positions being bought to open. These bulls appear to be buying the dip as AEO inches off yesterday's 52-week lows, up 0.7% at $13.18 at last glance. This month alone, the stock has lost 18.3%. Year over year, the equity is down 44.5%.

Pharmaceutical concern Perrigo Company PLC (NYSE:PRGO) is one of the top stocks on the New York Stock Exchange (NYSE) today, up 18.6% at $28.62 at last glance. The company announced a fourth-quarter earnings beat, as well as plans to simplify its self-care platform. Hitting its highest levels since August, today's pop has PRGO breaking into positive territory year to date and year over year.

Acadia Healthcare Inc (NASDAQ:ACHC) was last seen down 24.4% at $30.45, trading at four-year lows after disappointing fourth-quarter results and guidance. Furthermore, the stock was hit with a downgrade from Barclays to "equal weight" from "overweight," while BofA Global Researched lowered its price-target cut to $35 from $40.50, and TD Cowen slashed its price objective to $66 from $70. Over the last 12 months, ACHC has lost 63%.