Stocks are volatile amid a host of news and economic data

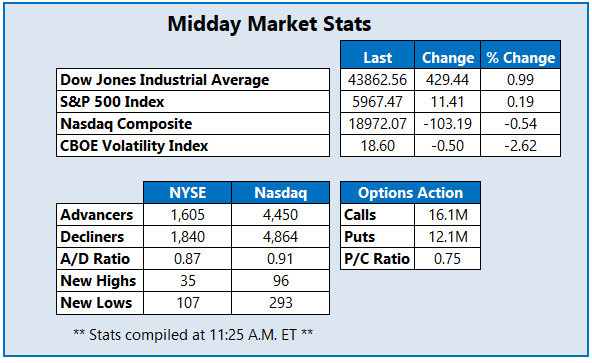

Stocks are seeing plenty of volatility today. Mirroring Nvidia's (NVDA) post-earnings reversal, the Nasdaq Composite Index (IXIC) pulled back sharply from its premarket lead, down triple digits midday. The Dow Jones Industrial Average (DJI), on the other hand, is sporting a 429-point gain, while the S&P 500 Index (SPX) sits modestly higher.

Global trade remains in focus, after President Trump announced 25% tariffs on Mexico and Canada going into effect next week, along with an additional 10% tariff on China. The U.S. dollar moved higher after the news, while the 10-year Treasury yield rebounds from recent lows. Elsewhere, jobless claims jumped higher than expected, while gross domestic product (GDP) showed showed the U.S. economy growing 2.3% in the fourth quarter.

Continue reading for more on today's market, including:

- Analysts chime in on Salesforce stock after earnings.

- Why this mining stock was upgraded.

- Plus, options bulls eye EBAY; and two stocks moving big post-earnings moves.

eBay Inc (NASDAQ:EBAY) is down 9% at $62.92, brushing off upbeat fourth-quarter results on a disappointing current-quarter outlook. Options traders are chiming in, with 14,000 calls and 18,000 puts exchanged so far, which is already 2.4 times EBAY's average daily options volume. The weekly 2/28 64-strike put is the most popular contract, followed by the March 65 call. Falling from last session's three-year highs, the e-commerce giant is up 32.1% year over year.

Insurance stock Root Inc (NASDAQ:ROOT) was last seen up 27.6% at $126.00 after the company's upbeat fourth-quarter results, which included earnings of $1.62 per share that smashed analyst estimates of 44 cents per share. The firm marked its first full year of net income profitability in 2024 as well. Climbing back up toward its mid-February three-year highs, ROOT is up 78.9% since the start of the year, and 363% in the past 12 months.

The New York Stock Exchange's (NYSE) Teleflex Inc (NYSE:TFX) is headed for its worst day ever, down 22.1% at $138.33 at last glance, after a disappointing full-year profit forecast. The medical equipment company also announced the retirement of CFO Thomas Powell, and that it was splitting into two publicly traded companies. Brushing off better-than-expected fourth-quarter results, TFX is trading at eight--year lows.