The Dow is down triple digits at last check

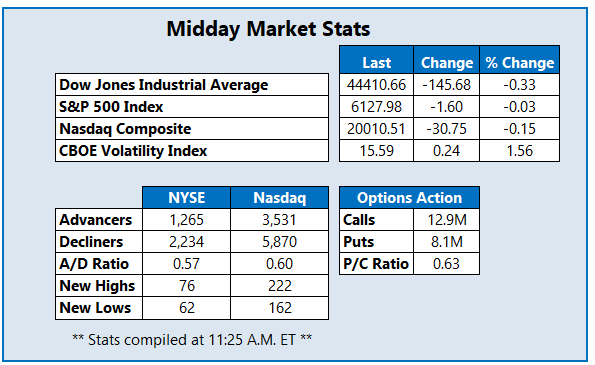

The Dow Jones Industrial Average (DJI) is down triple digits midday, while the S&P 500 Index (SPX) and Nasdaq Composite Index (IXIC) hover in the red as well. The former is falling from last session's record highs and the latter is poised to snap a four-day win streak, its best win streak of 2025 so far.

The Federal Reserve's meeting minutes are due out at 2 p.m. ET, with investors eager for insight into the central bank's inflation outlook, especially amid Trump tariffs weigh. In the meantime, building permits inched higher to a seasonally adjusted annual rate of 1.483 million, while housing starts came in at 1.366 million -- a 9.8% drop from December.

Continue reading for more on today's market, including:

- Acquisition buzz between two credit card giants.

- Analyst sees growth for this chip stock later this year.

- Plus, SolarEdge up off the mat; and two earnings reports to unpack.

Solar stock SolarEdge Technologies Inc (NASDAQ:SEDG) was last seen up 22.6% at $20.76, headed for its best day ever after the company smashed revenue estimates for the fourth quarter and issued an upbeat forecast for the first quarter. Long-term pressure at the 200-day moving average appears to be keeping gains in check, however. So far, SEDG has seen 35,000 calls and 25,000 puts cross the tape, which is already 4.3 times its average daily options volume. The weekly 2/28 25-strike call is the most popular, where new positions are being sold to open.

IT services name Adeia Inc (NASDAQ:ADEA) is up 24.8% at $16.82 at last glance, after the company posted record fourth-quarter revenue and highlighted strategic growth achievements. Earlier hitting a record high of $17.27, the stock is now up 41.1% year over year.

Footwear stock Wolverine World Wide Inc (NYSE:WWW) is down 17.3% at $15.49, after the company's disappointing full-year forecast, despite beating fourth-quarter earnings and revenue expectations. Headed for its worst single-session percentage loss since August 2023, the stock is still up 68.6% since last February.