The AI boom gave the Nasdaq a hefty boost this year

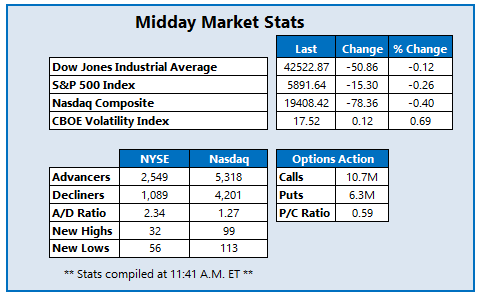

Stocks are lower midday, as Wall Street heads for its second consecutive winning year. The Nasdaq Composite Index (IXIC) is leading losses today with an 78-point drop, though the tech-heavy benchmark is outperforming the other two major indexes in 2024, thanks in part to the AI boom. Investors appear to be giving up hope on a major "Santa Claus rally" this week, with the market closed tomorrow for New Years Day.

Continue reading for more on today's market, including:

- Warren Buffett increases stake in VeriSign.

- Blackstone and EQT ink billion-dollar deal.

- Plus, options traders blasting falling biotech stock; FTAI surges on upbeat outlook; and PDYN pulls back from its extended surge.

Options traders are blasting Sangamo Therapeutics Inc (NASDAQ:SGMO) today, with 6,889 calls and 4,551 puts exchanged so far -- 7 times the average daily options volume. The January 2025 2-strike call is the most popular, followed by the January 2026 1-strike put. At last glance, SGMO was down 16% at $11.18 after coming back from much steeper losses, following news that Pfizer ended its co-development agreement with the biotech name for hemophilia A gene therapy.

FTAI Aviation Ltd (NASDAQ:FTAI) is one of the best performers on the Nasdaq today, up 16.8% at $147.76, after the company's encouraging 2025 guidance, and a price-target hike from BTIG to $190 from $180. Climbing back toward its Nov. 22 record high of $177.18, FTAI has added 218% in 2024.

Palladyne AI corp (NASDAQ:PDYN) is pulling back sharply after its recent surge, down 17.4% at $10.99 at last glance today and looking to snap a six-day win streak. In its most recent development, PDYN jumped yesterday after its drone was able to track a moving target for the first time. Since the start of December alone, the equity is up 72%.