Stocks are struggling for direction midday

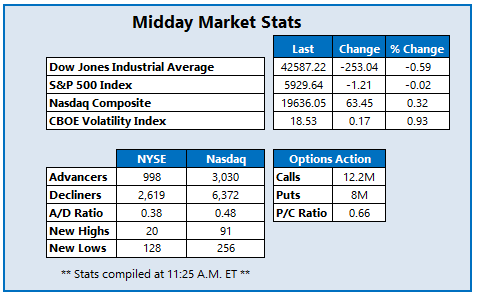

The Dow Jones Industrial Average's (DJI) end-of-the-week rebound appears to have been short-lived, as the blue-chip index falls triple digits to start the holiday-shortened week. Meanwhile, the S&P 500 Index (SPX) hangs out near breakeven, while the Nasdaq Composite Index (IXIC) manages a sturdy gain as investors unpack this morning's economic data. December's consumer confidence index fell to 104.7, its lowest level since September and below expectations of 113, while durable goods orders dropped 1.1% in November.

Continue reading for more on today's market, including:

Options bulls are targeting Blackberry Ltd (NYSE:BB) today, as the stock extends Friday's 23.8% post-earnings pop after an upgrade to "buy" from TD Securities. So far, 107,000 calls have been exchanged -- seven times the call volume typically seen at this point -- in comparison to 9,159 puts. The January 2025 5-strike call is the most popular, with new positions being bought to open there. At last look, BB was up 1.2% at $3.73.

Rumble Inc (NASDAQ:RUM) is at the top of the Nasdaq today, up 82.8% at $13.14 at last check, after the video streaming platform and cloud service provider said it would receive a $775 million investment from crypto name Tether. In response, Wedbush lifted its price target to $10 from $8. Now trading at fresh two-year highs, RUM is up 61% since the start of 2024.

Arm Holdings PLC (NASDAQ:ARM) is down 5.5% at $124.88 at last look, after news that fellow chipmaker Qualcomm (QCOM) secured a key victory in its lawsuit against the company. On the charts, familiar support at the $125 region could be keeping a cap on losses today. Year to date, ARM is up 66%.