The Dow has now logged four-straight triple-digit losses

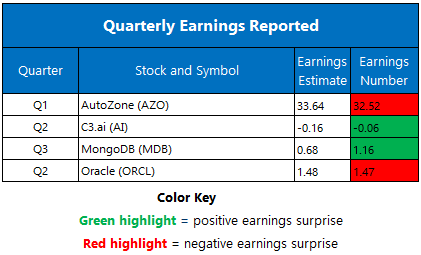

Stocks continued their sluggish price action today, with all three major indexes finishing modestly lower. The Dow logged its fourth-straight triple-digit loss as the tech sector continued to churn, with software stalwart Oracle (ORCL) a latest culprit. Wall Streetow braces for November's consumer price index (CPI) due out tomorrow morning, just as the Cboe Volatility Index logs its highest close in over two weeks.

Continue reading for more on today's market, including:

- Quantum computing just had a historic breakthrough.

- MongoDB stock can't capitalize on upbeat earnings.

- Plus, an emerging markets opportunity; a chip stock roundup; and EBAY upgraded.

5 Things to Know Today

- ServiceTitan will price its initial public offering (IPO) on Thursday. (MarketWatch)

- Electric vehicle (EV) survey reveals interesting purchasing habits. (Bloomberg)

- Emerging markets could benefit from Trump tariffs.

- 3 semiconductor stocks to keep an eye on

- Downgrade could spook eBay call bias.

Gold Stays Hot Ahead of CPI Data

Oil prices rose again today, albeit marginally, as middle east tensions and China's economic developments propped up black gold. For the session, January-dated West Texas Intermediate (WTI) crude added 22 cents, or 0.3%, to settle at $68.59 per barrel.

Gold prices rose leading up to the big CPI reveal tomorrow. For the session, gold for December delivery added 1.2% to settle at $2,718.40 an ounce.