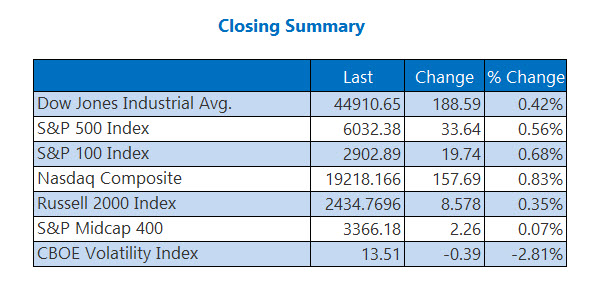

All major indexes rose for the day, week, and month

Returning from the Thanksgiving holiday, Wall Street closed the day, week, and month all higher. The Dow and S&P 500 scored record closes to wrap up their best months since November 2023. Tech powered the Nasdaq higher to daily, weekly, and monthly wins, while the small-cap Russell 2000 Index (RUT) logged its best month of the year as well. Against this growing bullish backdrop, investors' "fear gauge," the Cboe Volatility Index (VIX), just turned in its worst month since November 2020.

Continue reading for more on today's market, including:

- 2 U.S.-based chip stocks to watch amid reports of restrictions.

- Use these 3 key tips for successful contrarian trading.

- Plus, crypto stocks pop; a BTU buy signal; and revisiting this week's biggest stories.

5 Things to Know Today

- China is set to start limiting exports of critical metal tungsten this weekend, though alternative suppliers are beginning to reopen. (CNBC)

- The U.K. intelligence chief said Russia is conducting a “staggeringly reckless” sabotage campaign against Ukraine’s Western allies. (MarketWatch)

- Crypto-adjacent stock riding Bitcoin wave.

- 'Oversold' coal mining stock ready to rally.

- More on the stocks driving Wall Street's winning month.

There were no earnings of note today.

There was no unusual volume to report today.

Gold Heads for Worst Month of 2024

Oil prices posted a hefty 2.8% weekly loss, but moved higher for the day. The ceasefire between Israel and Hezbollah helped qualm worries that have lingered over crude supplies, while the Organization of the Petroleum Exporting Counties and its allies (OPEC+) delayed its meeting until Dec. 5. For the session, January-dated West Texas Intermediate (WTI) crude rose 54 cents, or under 0.8%, to settle at $69.26 per barrel.

Gold prices dropped 3% so far this month, and are on track for their worst month this year. However, bullion is higher today as the dollar falls and geopolitical tensions remain elevated. For the session, gold for December delivery was last seen 0.5% higher near $2,652.50 an ounce.