The Dow is the only benchmark on track for a weekly win

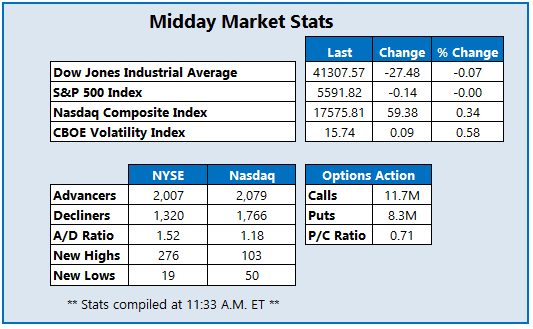

The Dow Jones Industrial Average (DJI) is sporting a modest midday loss, the S&P 500 Index (SPX) is flat, and the Nasdaq Composite Index (IXIC) is still higher despite paring premarket gains. The DJI is the only one pacing for a weekly win as it heads for a fourth consecutive monthly gain alongside the SPX, while the Nasdaq eyes its second monthly loss. Investors have the personal consumption expenditures (PCE) price index for July to unpack today, which was in line with analysts' estimates.

Continue reading for more on today's market, including:

- 2 software stocks seeing post-earnings tailwinds.

- Intel stock surges as chipmaker explores options.

- Plus, LULU brushes off earnings beat; American Airline stock pops; and chip stock under pressure.

Options traders are blasting Lululemon Athletica Inc(NASDAQ:LULU) today, after the retailer posted better-than-expected earnings and revenue for the second quarter. So far, 33,000 calls and 42,000 puts have been traded, which is nine times the intraday average amount. Expiring at the close, the weekly 8/30 250-strike put is the most active contract, with new positions opening there. Lululemon Athletica stock is 1.1% lower to trade at $256.08 at last check, though, after the company cut its annual profit forecast on slowing demand. Fresh off a recent Aug. 5, four-year low of $226.01, LULU remains down 49.4% in 2024.

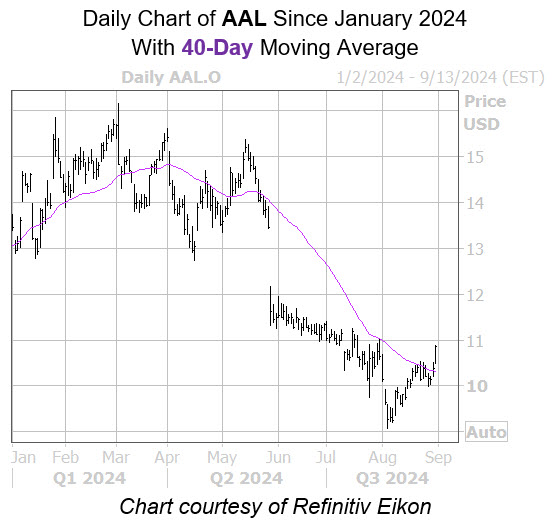

American Airlines Group Inc (NASDAQ:AAL) is one of the best stocks on the SPX today, up 4.1% to trade at $10.82. Though the shares remain below overhead pressure at the $11 level, which has been firmly in place since June, they yesterday nabbed their first close above the 40-day moving average since late May, after a bounce off an Aug. 5, four year-low of $9.07. Nevertheless, the

airline stock carries a 21% year-to-date deficit.

Super Micro Computer Inc (NASDAQ:SMCI) stock is among the SPX underperformers today, last seen 5.8% lower at $422.85. The shares carry a 47.8% quarter-to-date deficit, after facing rejection at the $650 level earlier this month, and are on track for their fourth loss in the last five sessions. The

chip stock still sports a 49.9% lead for 2024, though.